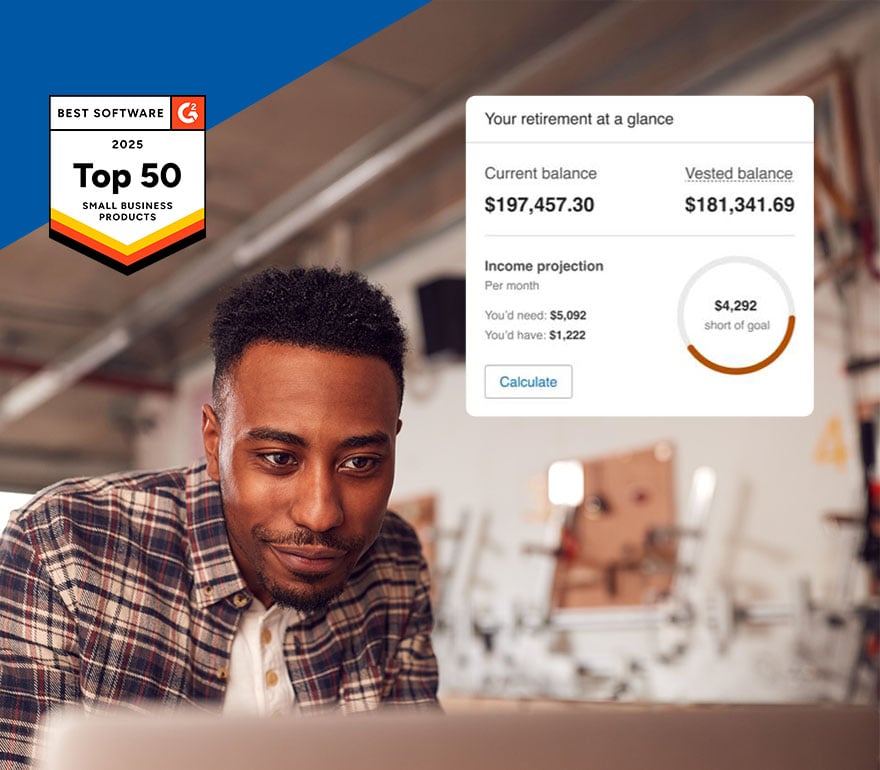

Gestione con confianza los recursos humanos, la nómina y los beneficios

Todo lo que necesita para encontrar, pagar y gestionar a su equipo en una sola plataforma.

Recursos humanos y nómina en una sola plataforma

Soluciones adecuadas para el tamaño de su empresa

Trabajador independiente

Paychex proporciona soluciones a propietarios de empresas independientes para que se paguen a sí mismos un salario a la vez que ahorran para la jubilación.

Empresas de 1 a 19 empleados

Las soluciones de Paychex para pequeñas empresas están personalizadas para las empresas con 1 a 19 empleados y pueden ayudarlo a ahorrar tiempo, reducir costos y cumplir con los reglamentos gubernamentales.

Empresas de 20 a 49 empleados

Las soluciones de Paychex ayudan con los desafíos de recursos humanos que enfrentan las empresas de 20 a 49 empleados, como la nómina, el apoyo a los empleados, los problemas de cumplimiento, etc.

Empresas que tienen de 50 a más de 100 empleados

Paychex ofrece soluciones para grandes empresas; una combinación de servicio y tecnología que colabora con sus esfuerzos por mantener el cumplimiento y el control de su infraestructura de recursos humanos.

Deje de desperdiciar tiempo en recursos humanos y nómina

¿Se cansó de que las tareas de nómina, impuestos y recursos humanos le consuman el día? Pague a su personal en cuestión de minutos a través del sencillo software en línea diseñado para agilizar la nómina, automatizar impuestos, simplificar los recursos humanos y beneficios, y mucho más.

Conozca lo que dicen algunos de nuestros clientes

"El tiempo del día que no invierto en (nómina)… realmente cambia mi rutina diaria. Me permite hacer llamadas telefónicas, responder correos electrónicos, hablar con contratistas generales y con mi franquicia (empleados). Tener la capacidad de hacer eso agiliza ambos procesos".

“Poder promocionar las vacantes con las diferentes plataformas que tiene Paychex, hacer que nuestros puestos sean visibles y atraer a más candidatos han hecho que el proceso de incorporación sea mucho más sencillo para que contratemos personal lo antes posible”.

“Gracias a Paychex, tengo la libertad de trabajar en el negocio sabiendo que nuestra nómina está bajo control y que se administra día a día; no tengo que preocuparme por eso, lo que es genial”.

"Teníamos otro tipo de programa de compensación de los trabajadores y descubrí muy pronto que, cuando no lo controlas bien a lo largo del año, se puede ir acumulando. [Ahora] sabemos con exactitud lo que pagamos al final del año y, honestamente, eso nos ayudó mucho con nuestro presupuesto”.

"Para que me vaya bien en mi negocio, básicamente, tengo que prestar mucha atención a la calidad, la capacitación y los empleados. Por eso, con todo esto en mente, me alegra mucho trabajar con Paychex, ya que facilitan mi trabajo".

“Paychex es una empresa honesta. Proporciona una plataforma de alta calidad y sus empleados siempre están alegres y dispuestos a ayudar, y son amables. Me tratan como yo trato a mis clientes“.

Vea qué paquete se adapta a las necesidades de su negocio

Seis preguntas rápidas para darle una recomendación personalizada dentro de 2 a 3 minutos. Hay opciones de paquetes de Paychex que se adaptan a las necesidades de empresas de cualquier tamaño.

¿Cuántos empleados tiene?

Únase a aproximadamente 800,000 clientes y obtenga ayuda para administrar los recursos humanos, la nómina y los beneficios

Preguntas frecuentes sobre Paychex

-

¿Qué es Paychex?

¿Qué es Paychex?

Paychex es una compañía de beneficios, recursos humanos y nómina cuya misión es ayudar a las empresas a tener éxito. Con nuestra galardonada combinación de tecnología digital de recursos humanos y servicios de asesoramiento, podemos ayudarlo a simplificar sus complejos desafíos comerciales.

-

¿Paychex se dedica a las nóminas?

¿Paychex se dedica a las nóminas?

Sí, somos una empresa de nómina que ofrece servicios de nómina a pequeñas y medianas empresas desde hace más de 50 años. Brindamos procesamiento fácil, administración tributaria automatizada, autoservicio para empleados, métodos flexibles para entregar sus cheques de pago y más. Para obtener más información sobre nuestra solución de nómina, visite nuestra página de productos.

-

¿Qué servicios ofrece Paychex?

¿Qué servicios ofrece Paychex?

Además de los servicios de nómina para empresas de todo tamaño, Paychex ofrece tecnología y apoyo integral, incluido lo siguiente:

-

¿Qué es Paychex Flex?

¿Qué es Paychex Flex?

Paychex Flex es nuestra plataforma integral para todo lo relacionado con RR. HH.: nóminas, tiempo y asistencia, y mucho más. Lo mejor de todo es que ofrecemos un apoyo flexible para responder sus preguntas, y ayudarlo cuándo y dónde lo necesite.

-

¿Cuál es la diferencia entre Paychex y Paychex Flex?

¿Cuál es la diferencia entre Paychex y Paychex Flex?

Paychex ofrece servicios de subcontratación de nómina, recursos humanos y beneficios para empresas de todos los tamaños. Paychex Flex es una plataforma basada en la nube que brinda acceso a estos servicios, lo que les permite a las empresas administrar la nómina, las tareas de RR. HH. y los beneficios en una interfaz fácil de usar. Obtenga más información sobre nuestra compañía o use la página de inicio de sesión de Paychex Flex si es un cliente actual o su empleado.

-

¿Paychex Flex es fácil de usar?

¿Paychex Flex es fácil de usar?

Paychex Flex está diseñado pensando en los usuarios finales, lo que permite realizar tareas esenciales fácilmente, como agregar empleados, actualizar ofertas de beneficios, ejecutar informes de recursos humanos y mucho más. La plataforma puede ayudar a automatizar las funciones clave de recursos humanos, nómina y beneficios a través de una única plataforma con la aplicación Paychex Flex, que es similar a la experiencia de escritorio.

-

¿Cuánto cuesta Paychex Flex?

¿Cuánto cuesta Paychex Flex?

Los precios de Paychex Flex dependen de la cantidad de empleados y las necesidades de su negocio. Para obtener un presupuesto personalizado, póngase en contacto con nuestro equipo de ventas.

-

¿Paychex ofrece servicios de PEO?

¿Paychex ofrece servicios de PEO?

Sí, Paychex ofrece servicios de PEO (entre otros) y apoya a empresas de todos los tamaños con sus responsabilidades administrativas de recursos humanos. Puede esperar lo siguiente:

- Soporte dedicado para su empresa por parte de un especialista en nómina, socio comercial de recursos humanos y defensor del cliente

- Una solución personalizada adaptada a sus necesidades únicas

- Transparencia incomparable con facturas detalladas y claros desgloses de los costos

Para obtener más información sobre nuestros servicios de PEO, visite nuestra página de productos.

-

¿Cuán seguro es Paychex?

¿Cuán seguro es Paychex?

Nuestra máxima prioridad es mantener segura y protegida su información personal y de cuenta. Estas son solo algunas de las formas en que cumplimos esa promesa. Específicamente, nosotros hacemos lo siguiente:

- Mantenemos políticas y procedimientos que cubren el acceso físico y lógico a nuestros lugares de trabajo, sistemas y registros.

- Aplicamos medidas de seguridad físicas, electrónicas y de procedimiento alineadas con las mejores prácticas reconocidas por la industria.

- Utilizamos tecnología como copias de seguridad, detección y prevención de virus, firewalls y demás hardware y software informático para proteger contra el acceso no autorizado o la alteración de los datos de los clientes.

- Ciframos la información confidencial que se transmite a través de Internet.

-

¿Cuánto tiempo requiere poner en marcha los servicios de Paychex?

¿Cuánto tiempo requiere poner en marcha los servicios de Paychex?

Dependiendo de los servicios que le interesen, si está cambiando a los servicios de nómina de Paychex desde otro proveedor, trabajaremos con usted para recopilar la documentación necesaria y balancear sus datos de nómina del año hasta la fecha. Para que el registro de Paychex Flex sea aún más rápido, a menudo podemos ayudarlo a extraer sus datos directamente del sistema de nómina de su compañía anterior.

-

Paychex Flex vs. SurePayroll: ¿Cuál es la diferencia?

Paychex Flex vs. SurePayroll: ¿Cuál es la diferencia?

Paychex Flex y SurePayroll son soluciones digitales que las empresas pueden utilizar para el procesamiento de nóminas y para simplificar su flujo de trabajo diario.

- Paychex Flex atiende a pequeñas, medianas y grandes empresas, y ofrece una solución personalizable de recursos humanos, nómina y beneficios que puede crecer al mismo tiempo que su empresa.

- SurePayroll atiende a pequeñas empresas y empleadores domésticos con un enfoque en integraciones esenciales y procesamiento simple de nómina.

-

¿SurePayroll es una empresa de Paychex?

¿SurePayroll es una empresa de Paychex?

Sí, SurePayroll es una subsidiaria de Paychex. Al diversificar nuestras ofertas, podemos brindar a nuestros clientes opciones de soluciones de nómina, recursos humanos y beneficios que satisfacen sus necesidades específicas.