We Make Switching Payroll Companies Simple

When you switch payroll providers and work with us, we’ll help you:

-

Pull historical data directly from your previous system

-

Collect any necessary information to set up your account

-

Process the first few payrolls for you while balancing year-to-date payroll data

We’ll Do the Work for a Smooth Transition

Simply provide some necessary information (federal ID number, employee bank accounts, etc.), and we’ll set up your account. We can often help you pull your data directly from your previous payroll company's system to make things go even faster.

Experienced Payroll Support Every Step of the Way

Our highly trained representatives can help with your payroll questions each step of the way throughout the onboarding process:

- Sales representatives will help you gather the necessary information before changing payroll systems

- Implementation specialists will audit back to the beginning of the year and process your first few payrolls for you

- After onboarding, you can choose flexible payroll support options that fit your business needs

A Comprehensive Suite of Payroll and HR Solutions

What Clients Say When Switching to Paychex

89%

recommend Paychex

89% would recommend other companies switch to Paychex1

91%

could focus on higher-level tasks

91% state Paychex services enabled HR department to focus on higher-level tasks1

88%

had positive onboarding

88% say onboarding and implementation with Paychex was positive4

84%

say switching was easy

84% say switching to Paychex was easy and seamless4

Switch To a Trusted Name in The Industry – Here’s Why:

Flexible Payroll Support

We’re here to help whenever you need it. With our customer support options, you can choose the level of service that works best for your business.

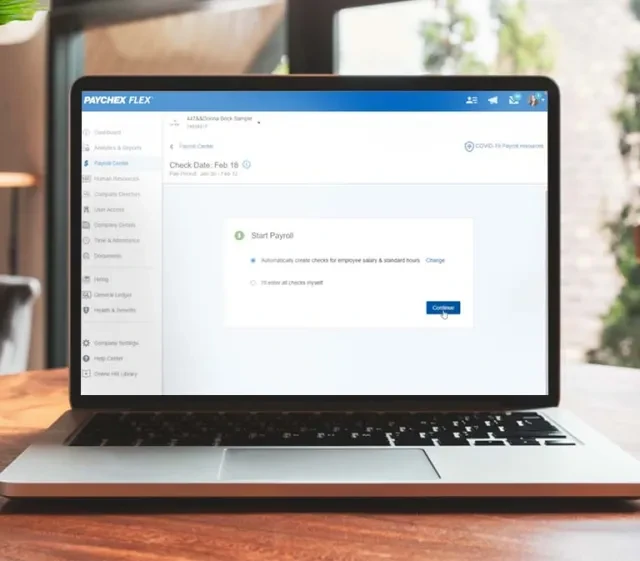

All-in-One, Scalable Technology

Paychex Flex® is an all-in-one, cloud-based platform that can be your HR everything. Recruit, hire, pay, and manage your team from one place.

Protection Against Mistakes

Our payroll services have built-in safeguards, such as notifications to alert you of potential payroll issues that can help ensure each payroll runs as smoothly as possible.

Employee Self-Service

Spend less time answering employees’ questions by giving them controlled access to their payroll information online, including access to past check stubs, direct deposit, W-2s, and more.

Compliance Expertise

When you work with us, our in-house analysts monitor the ever-changing regulatory landscape. Whether at a federal, state, or local level, we help you stay informed of changes that may apply to your business.

See How We Can Help

Software that Fits the Needs of Any Size Business

Preview our solution so you can get comfortable with our offerings when choosing the level of technology that works for your business – we’re built to grow with you.

What Our Clients Are Saying About Switching to Paychex

TYR Tactical CFO Kevin Hull wanted to help his HR manager resolve some challenges. When they switched payroll providers, Paychex worked with their team to ensure every detail was explained and worked out beforehand.

"Nobody is excited about changing payroll companies. It is quite a bit of work to go through. You’re anxious leading up to that time making sure everything works out …. [With Paychex] when it got to go time, I had no uneasiness that the payroll process was going to work flawlessly. And it did."

Frequently Asked Questions

-

Is It Hard To Switch Payroll Companies?

Is It Hard To Switch Payroll Companies?

An effective payroll company should make it simple to switch from your current service, and offer guidance on how to switch payroll providers. When evaluating new providers, look for a payroll company that’s focused on getting you up and running quickly, including working with you to collect the necessary paperwork and balance your year-to-date payroll data, and helping pull your data directly from your previous payroll company’s system.

-

How Long Does It Take To Switch Payroll Providers?

How Long Does It Take To Switch Payroll Providers?

The process of switching payroll companies can take as few as two business days or up to a few weeks, depending on the provider you choose and how quickly you can provide the necessary information to your new payroll provider. Make sure to allow for ample time during this process so that there’s no impact on running current payroll.

-

How Do I Terminate a Payroll Company Contract?

How Do I Terminate a Payroll Company Contract?

Before terminating your contract or switching payroll providers, review the terms of your current service. If you are in a contract with the payroll company, your business may be subject to a charge if you end service before the contract ends. Contact the company directly and speak with a representative, who can provide specific information on the steps needed to terminate payroll service.

-

When Is the Best Time To Switch Payroll Providers?

When Is the Best Time To Switch Payroll Providers?

You can switch payroll companies at any point in the year, but there are certain times when it can make the payroll transition process simpler. For instance, switching payroll companies quarter-end or year-end may be more convenient, primarily due to business tax filing deadlines. The contract with your current provider and its terms may also factor into this decision, so you may find switching payroll companies mid-quarter or changing payroll providers mid-year may make more sense based on your current service agreement.

-

How Do I Switch Payroll Providers?

How Do I Switch Payroll Providers?

In addition to determining when you want to make the payroll transition, evaluate your payroll service needs — they may have changed since you started payroll service with your current provider. Switching payroll providers will also require notifying your current payroll provider, signing a service agreement with your new payroll company, providing the necessary information for service setup, and notifying employees about the change and how it may impact payrolls moving forward. Consider these steps as a general switching payroll companies checklist, but make sure to check with your new provider for any specific steps you must take.

-

What Information Do I Need To Provide To Switch Payroll Providers?

What Information Do I Need To Provide To Switch Payroll Providers?

Your new payroll provider will need the following information to complete the payroll transition:

- Your name, email address, and phone number

- The company’s Federal Tax ID Number

- Employees’ personal, payment, and tax information

- Your company’s tax information

- Business bank account details

- Signed federal and state tax documents and service agreements

-

Why Should I Switch to Paychex?

Why Should I Switch to Paychex?

If you’re looking to switch payroll providers, Paychex offers leading payroll and tax filing services, industry-leading technology, and flexible customer support options. Compare some of the leading small business payroll systems, including the services and features they offer.