Payroll Services Made Easy

Pay your people in just a few clicks through our simple online payroll software with flexible processing, automated tax administration, and employee self-service that can adapt to your changing needs. Reach a sales representative today at 855-263-1021.

Scalable Payroll Solutions To Grow With You

Online Chat Support Is Available 24/7

Compliance Information To Help You Stay Ahead of Changes

Automatic Payroll Tax Calculations and Payment

Helping Businesses of All Sizes

Paychex Flex®: Our Payroll Processing Software

-

Manage with Ease

Manage with Ease

View your current and future pay periods to complete on the next payday, all within the Payroll Center.

-

Access Critical Reports

Access Critical Reports

Depending on your package, you can customize reports to help make better business decisions. Create your payroll journal, cash requirements, and more.

-

Receive In-Platform Support

Receive In-Platform Support

Use our Help Center to access current information, chat features, articles, and how-to guides for activities and tasks.

-

Easily Add New Employees

Easily Add New Employees

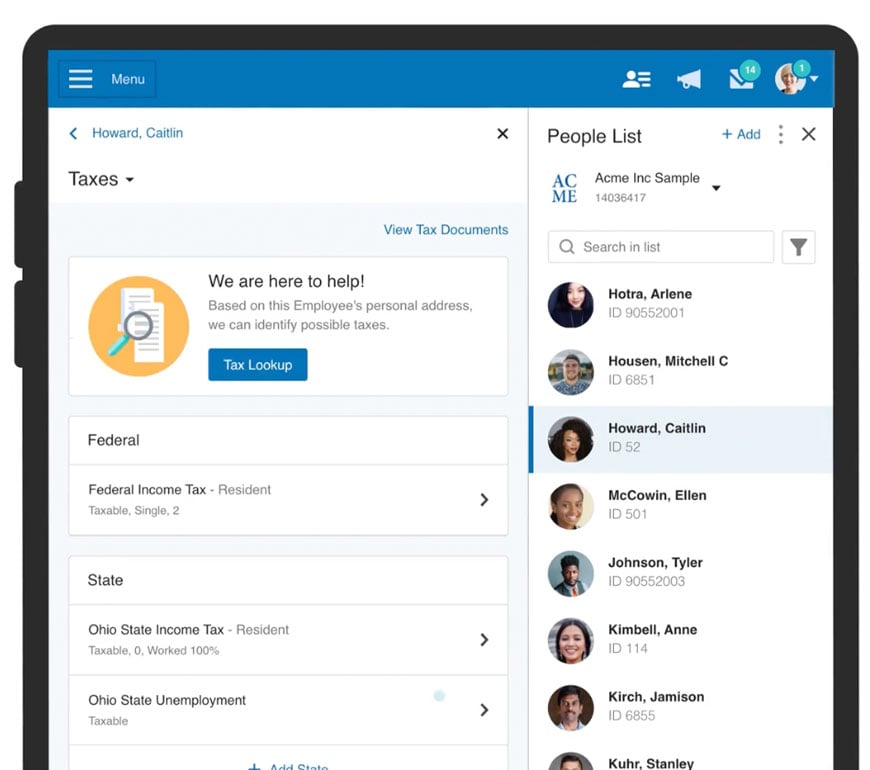

Adding new employees and contractors is just a few clicks away within the People section of Paychex Flex.

Automate Taxes and Reduce Risk

Automatic Tax Administration

You’ll get access to Taxpay®, our automatic tax administration service, when you choose to process payroll with us. We calculate, pay, and file your taxes with the appropriate agencies – saving you time and reducing your risk of costly errors.

Reduce Potential Compliance Risks

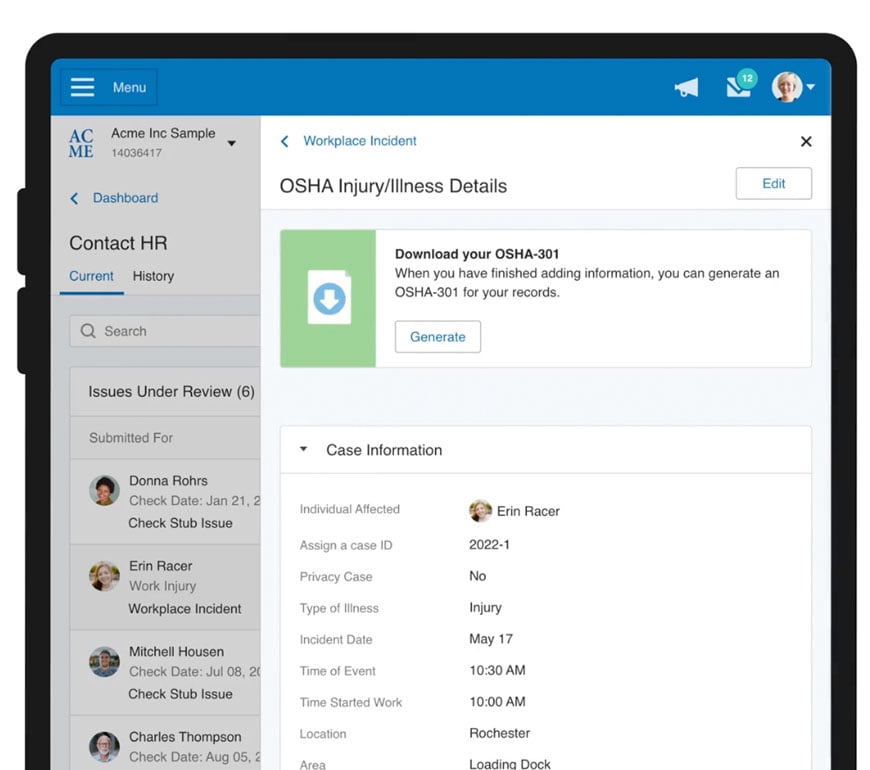

Access critical information or work with a dedicated HR professional to help stay up to date on federal, state, and local legislative changes – while our payroll management system helps simplify your payday.

Paychex HR Library

Always be plugged into the latest payroll information, employment law changes, and best practice information. This compliance tool can help keep you informed while you mitigate risk.

Payroll Protection

You can extend the collection of funds from your bank account for up to seven days without interruption of services or extra fees with the help of our protection service, Paychex Promise®2.

Flexible Package Options

Paychex Flex® Select

Get expert service to match your business needs. Process payroll, file taxes online, and have access to online employee training and development. For businesses of any size.

Paychex Flex® Pro

Full-service setup, payroll, and tax filing online, plus, additional HR options. For businesses of any size.

Paychex Flex® Enterprise

The complete large business payroll and HR solution, helping you stay compliant, train employees, gain insights through custom analytics, and more.

Integrate With Software Tools You Already Use

Save time and reduce costly errors when you connect and share data between our payroll software, Paychex Flex®, and dozens of other business applications.

Save Time and Increase Efficiency

Employee Self-Service

Employees can take care of tasks themselves, such as enrolling in benefits or updating personal information. With our all-in-one HR and payroll software, everyone can be more productive.

All-in-One Solution

You can do more than use our software for payroll. Paychex Flex can be your HR everything and help you with recruitment to retirement efforts – and several other functions in between.

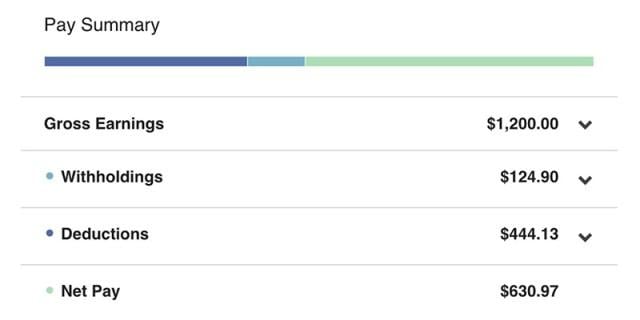

Payroll Accuracy

Identify discrepancies and possible costly errors with Paychex Pre-check℠, allowing admins and employees to preview paystubs before your payroll processes.

Reporting & Analytics

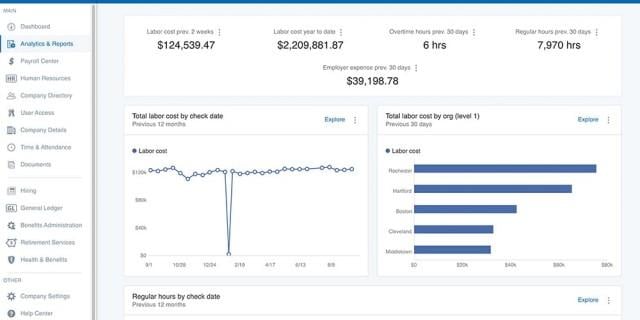

Uncover trends for better decision-making with interactive reports and insights. Our payroll system allows you to customize your data and access our library of 160 standard reports for answers.

Industry-Tailored Payroll Technology

No matter what industry you’re in – Paychex payroll is here to help you simplify payday, automate tax filing, and stay compliant with changing regulations.

Why approximately 800,000 Businesses Trust Paychex

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes."

"StratasCorp Technologies was quickly outgrowing their payroll provider. Paychex helped them save 10 hours a month and $10,000 a year in tax penalties".

"We thought about doing our own payroll … and it would take maybe 5 to 7 hours …. With state and federal rules constantly changing, it would be difficult to keep up on … and I don’t want to make a mistake with my payroll … I want to get my workers paid and paid right."

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”

Paychex Payroll Services Frequently Asked Questions

-

What Does a Payroll Processing Company Do?

What Does a Payroll Processing Company Do?

Payroll processing companies are designed to simplify your payroll workload by managing, maintaining, and issuing payments to your employees. This can also include assistance with calculating, filing, and paying payroll taxes. If you choose to work with Paychex, we can help with all your payroll, HR, and benefit needs with convenient and flexible packages that are designed to work for you.

-

How Do I Choose a Payroll Company?

How Do I Choose a Payroll Company?

Finding the best payroll software for small business may take some time and effort, but the payoff is worth it. The payroll services your business needs depends on many factors, and should be able to meet your needs now and as your business changes and grows. We can work with you to help you choose a payroll solution for small business that best fits your needs. Learn more about how to choose a payroll company, essential questions to ask during the process, and features to look for in a top payroll provider.

-

Can I Do Payroll Online?

Can I Do Payroll Online?

It’s possible to complete many payroll functions online, and many payroll companies offer online services for essential payroll items such as completing new-hire paperwork (Form W-4, I-9, etc.) and reporting, filing and making payroll tax payments, tracking employee time off and benefits, and much more. Look for online payroll services such as Paychex Flex to help simplify and streamline your payroll process.

-

What Information Do I Need for Payroll?

What Information Do I Need for Payroll?

There are many important pieces of information required to complete payroll. In addition to pertinent business information (e.g., federal employer identification number, state ID number, workers’ compensation coverage), you will also need to gather specific pieces of employee information before getting payroll started, including worker classification, new-hire documents, and employee payment methods. Learn more about everything you need to run payroll.

-

How Do I Set Up Payroll for My Employees?

How Do I Set Up Payroll for My Employees?

Setting up payroll for your employees requires many steps (and is dependent on federal and state requirements that apply to your business), including:

- Having employees complete Form W-4 and other new-hire documents

- Applying for your federal employer identification number

- Selecting your payroll schedule

- Correctly calculating and withholding taxes from employee paychecks

- Filing and submitting quarterly and annual employer payroll taxes

-

Why Should I Use Paychex Payroll Services?

Why Should I Use Paychex Payroll Services?

Whether you’re looking to outsource payroll for the first time, or are looking to switch payroll providers, it’s important to know that not all providers offer the same services. Here’s a comprehensive comparison of some of the most popular payroll companies among small businesses, including the services and features they offer.

-

Is It Difficult To Switch to Paychex From My Current Payroll Provider?

Is It Difficult To Switch to Paychex From My Current Payroll Provider?

Switching to Paychex is simple. We can have you up and running quickly and easily. We work with you to collect the necessary paperwork and balance your year-to-date payroll data, and often we’re even able to help pull your data directly from your previous payroll company’s system.

-

What Do I Need To Sign Up for Paychex Payroll Services?

What Do I Need To Sign Up for Paychex Payroll Services?

To begin the process, just submit your name, email address, and phone number. To speed up the enrollment process be sure to be ready to provide the following:

- Company and employee information, including Federal Tax ID Number; employees’ personal, payment, and tax information; your company’s tax information; and your bank account details

- Year-to-date payroll information

- Signed tax documents and agreement, including federal and state* tax documents and service agreements

Once your enrollment application has been reviewed by our Customer Support team, you can start running your first payroll.

*A wet signature may be required on your state tax documents. We’ll let you know.

-

What Payroll Support Options Does Paychex Offer?

What Payroll Support Options Does Paychex Offer?

Whether you prefer self-service, payroll support with an available Paychex representative, or an assigned Paychex payroll representative, our tailored and flexible customer support solutions ensure you maximize the value of our partnership.

-

My Company Is Growing. How Easy Is It To Adjust My Package or Add Solutions?

My Company Is Growing. How Easy Is It To Adjust My Package or Add Solutions?

Whether you have five employees, or 5,000 employees, each of our payroll packages and solutions are built to grow with you. Your Paychex representative can help you easily add services as they become necessary, as well as recommend solutions that may better fit the changing needs of your business.

-

Can Paychex Help With More Than Just Payroll?

Can Paychex Help With More Than Just Payroll?

Beyond payroll, we allow you to get more from your people, money, and productivity by helping you solve your human resources challenges, create and manage your benefits program, find insurance to protect what you’ve worked hard to build, and help keep you up-to-date with changing laws and regulations. In addition, our dedicated Paychex HR professionals can work with you to make you aware of any potential HR issues and provide you with guidance on how to solve them based on their extensive knowledge and experience. Need help finding a solution? Use our solution finder to explore your options.