Trusted Employee Benefits Services

Benefits don't have to be complicated or costly:

- Integrate with payroll: Automate deductions to eliminate manual entry

- Use your current broker: Less complexity at no extra cost

- Flexible plans: Pick only what fits your size and budget

The result? Simplified open enrollment and happy employees.

Scroll Down

To Discover More

Invest in Your Team With Flexible Benefit Packages

Design an Employee Benefits Package As Unique as Your Team

Why Businesses Trust Paychex for Benefits

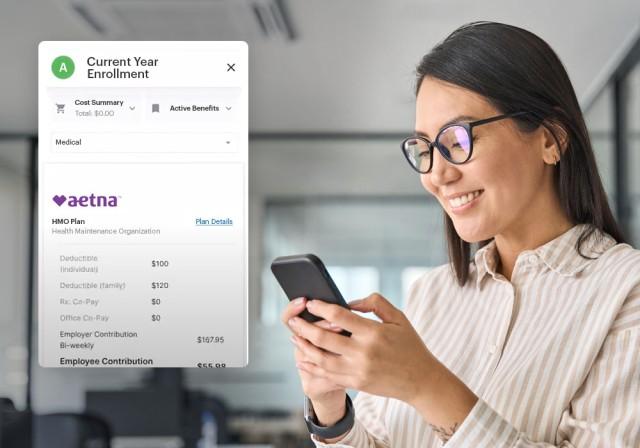

Secure Benefits Platform

Our streamlined web-based navigation and online employee plan enrollment help simplify your insurance administration and work with many existing payroll providers.

Let Us Do the Heavy Lifting

Licensed agents take the load off by helping enroll your employees, coordinating with insurance carriers, and streamlining payroll deductions so you can save time, reduce stress, and focus on growing your business.

National Insurance Carrier Relationships

We partner with hundreds of highly rated national insurance carriers to offer a wide range of health plans to fit your team’s unique needs.

Expert Compliance Support

Get guidance to help you confidently navigate the regulatory complexities of healthcare reform and stay aligned with compliance requirements, such as HIPAA and ERISA.

How You Can Benefit from Employee Solutions

At Paychex, we keep things flexible because we know every business is different. Chat with one of our specialists to craft the solutions that work perfectly for your team.

Paychex Insurance Agency

Connect with top-rated carriers and let our licensed agents build and compare plans and features for you. Save time, reduce administrative overhead by integrating with payroll and let us handle the hard work.

Paychex Retirement Services

Our team offers retirement plan services tailored to your needs, whether bundled with other solutions or available à la carte. We’ll guide you through options, create the right plan, and collaborate with your financial advisor if needed.

Paychex PEO

Our all-in-one HR solution streamlines benefits, HR, payroll, and compliance management, often at lower costs than the open market. We’ll handle plan development with carriers, giving you access to top-tier benefits.

“Not only did it save us $120,000 annually, but the time savings that it gave us to give back to the company helped us run more efficiently and helped get us where we need to be.”

Tiffany Hadsell, CFO

Hunger + Thirst Group

Solutions That Complement Employee Benefits

Experience the strength of Paychex through seamless, integrated solutions on one easy-to-use platform.

Say Goodbye to Benefits Stress and Hello to a Happier Team

Make your life easier by contacting a benefits specialist for help creating a plan tailored to your business.

Employee Benefit FAQs

-

Why Are Employee Benefits So Important?

Why Are Employee Benefits So Important?

Employee benefits play a crucial role in recruitment and retention. Offering benefits attracts top talent, as most job seekers prioritize employers with strong employee benefits packages. Additionally, employees with benefits are more likely to stay, reducing turnover and saving businesses on replacement and onboarding costs.

Many businesses, especially small businesses, may feel overwhelmed with benefits choices. That’s why we offer benefits administration tools that help you choose, set up, and manage your benefits package.

-

How Do You Offer Employee Benefits?

How Do You Offer Employee Benefits?

Offering employee benefits doesn’t have to be difficult or costly. With the right plan and support, you can create a benefits package that works for both your business and your employees. Here’s how you can do it:

- Determine Your Budget – Assess how much your business can allocate for employee benefits.

- Choose Employee Benefits – Select the benefits you want to offer, such as health insurance or retirement plans. Work with a licensed agent to explore options and help you stay compliant with regulations.

- Partner with a Provider – Collaborate with Paychex Insurance Agency to access top-tier carriers and customize plans that fit your employees' needs.

- Simplify Open Enrollment – Streamline the open enrollment process with Paychex Insurance Agency’s support, making it easy for employees to select and enroll in their benefits.

-

What Benefits Are Legally Required in the US?

What Benefits Are Legally Required in the US?

Federally mandatory employee benefits in the United States include:

- Social Security and Medicare

- Unemployment insurance

- Workers' compensation insurance

These federally required benefits ensure essential protections for employees. Depending on your business location, additional requirements may vary by state or local laws.

If a company fails to provide federally mandated employee benefits, such as Social Security, Medicare, unemployment insurance, or workers' compensation, it may face significant legal and financial consequences. These can include fines, penalties, lawsuits, and potential damage to the company’s reputation. Additionally, non-compliance with federal, state, or local laws could result in audits or enforcement actions by government agencies.

-

How Much Do Employee Benefits Cost?

How Much Do Employee Benefits Cost?

Employee benefits costs vary based on the type and complexity of the plans you choose. Factors like health insurance, retirement plans, and additional perks can impact the overall expense. A Paychex HR partner can help you design a benefits package that aligns with your business budget, goals, and company culture, ensuring you get the most value for your investment.

-

What Employee Benefits Are Most Important?

What Employee Benefits Are Most Important?

The most important employee benefits often start with legally required ones. These include unemployment insurance, workers' compensation, and other mandated benefits based on federal and state laws.

Beyond these, voluntary benefits like dental or life insurance, flexible spending accounts (FSA/HSA), and 401(k) plans play a key role in attracting and retaining employees.

Many employees also value non-traditional benefits such as stock options, tuition reimbursement, and remote work options, which can boost job satisfaction and engagement. Offering a balanced mix of mandatory, voluntary, and non-traditional benefits helps meet diverse employee needs.

-

How Do Employee Benefits Impact Job Satisfaction?

How Do Employee Benefits Impact Job Satisfaction?

Employee benefits significantly impact job satisfaction by fostering financial security, well-being, and personal support for employees. Offering comprehensive benefits like health insurance, retirement plans, and voluntary perks such as flexible spending accounts or remote work options helps employees feel valued and motivated. These benefits improve engagement and productivity and play a key role in retaining top talent and enhancing overall workplace satisfaction.

-

What Should Small Businesses Consider When Selecting Employee Benefits Packages?

What Should Small Businesses Consider When Selecting Employee Benefits Packages?

When selecting employee benefits packages, small businesses should focus on their:

- Budget

- Employee needs

- Legal compliance

Prioritize options like health insurance, retirement plans, and voluntary benefits that provide the most value to your team. Tailored solutions, like those offered by Paychex, can help simplify management and ensure your benefits package aligns with your business goals while staying competitive in attracting and retaining talent.