Payroll Services for 1099 Contractors

Manage payroll for your independent contractors more confidently. Enjoy an easy online setup process to help you make accurate payments and meet tax requirements.

Peace of Mind for 1099 Payroll Taxes

Say Goodbye to Tax Season Stress

Tired of manual paperwork and last-minute tax scrambles? Paychex helps you automate your 1099-NEC filing, eliminating the hassle and supporting timely submissions.

Simplify Multi-State Contractor Payments

Let us help you with the complexities of multi-state compliance so you can pay your contractors accurately, no matter where they’re located.

Access Tax Forms Anytime, Anywhere

Access W-9 forms and other important documents whenever you need them, simplifying audits and helping you ensure compliance.

Get Expert Support When You Need It

Rely on Paychex’s expert support to guide you through the 1099 process, helping with timely and accurate payments.

Easy Set Up and Management of Independent Contractor Payroll

Step 1. Add Independent Contractors

Easily onboard 1099 workers.

Step 2. Set Up Payments

Choose bank transfers, prepaid cards, or checks.

Step 3. Automate Tax Forms

Generate and send 1099 forms at year-end.

Step 4. Track Payments

Stay on top of contractor payments with real-time reporting.

Payroll for Every Contractor or Employee

No matter your team—employees, independent contractors, or both—our payroll software has you covered. Easily handle payments, records, and forms, pay your team in any state, and get expert support whenever you need it!

Payroll for Independent Contractors in All Industries

Industries like healthcare, IT, construction, professional services, and real estate often depend on 1099 workers to get the job done. Managing payments for independent contractors doesn’t have to be complicated. Streamline the process with tools tailored to your industry’s needs.

Additional Resources To Help Pay Independent Contractors

Common Questions About Paying Independent Contractors

-

How Does Independent Contractor Payroll Work?

How Does Independent Contractor Payroll Work?

Managing payroll for independent contractors is a bit different from handling traditional employees. Instead of withholding taxes, businesses typically pay independent contractors the agreed-upon amount for their work, and it’s up to the workers to manage their own tax obligations. Contractors usually receive a 1099 form at the end of the year or the beginning of the next year, summarizing the total payments made to them. This simple process allows for flexibility, but both parties need to stay on top of their responsibilities to ensure compliance.

-

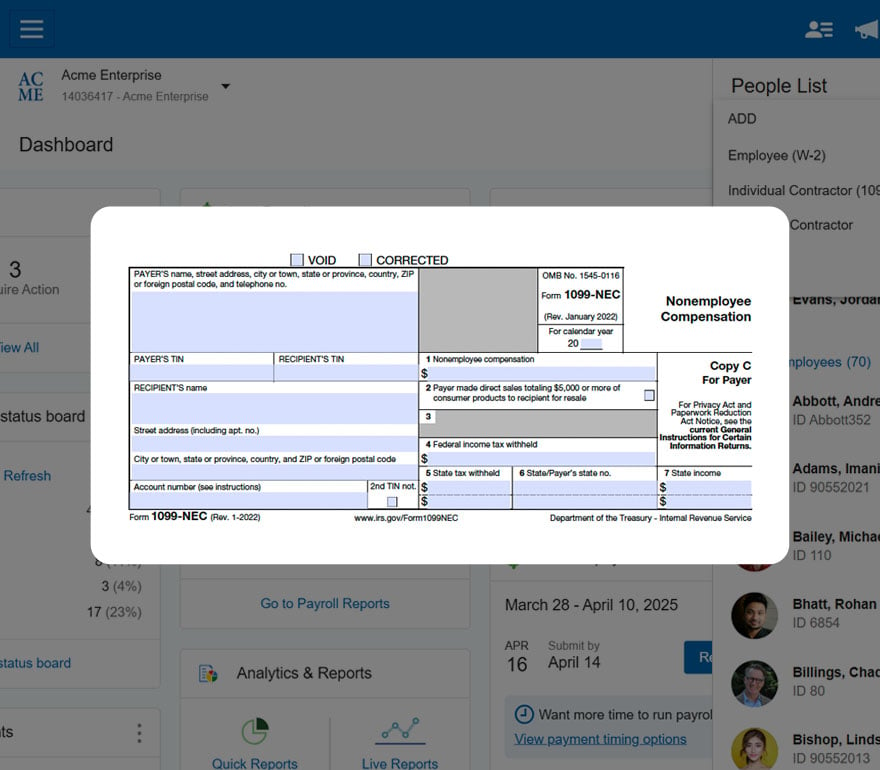

What Forms Do I Need for 1099 Contractors?

What Forms Do I Need for 1099 Contractors?

When working with 1099 contractors, you’ll need the 1099-NEC form to report payments of $600 or more during the year. Gather accurate details during onboarding, like the contractor’s name, address, and Taxpayer Identification Number (TIN), using IRS Form W-9. Once you have these, you can file the required forms. For more on 1099 vs. W-2 forms, check out our guide on 1099 vs. W-2. It’s vital that you and your independent contractor maintain proper documentation for compliance.

-

What’s the Difference Between Independent Contractors and Employees?

What’s the Difference Between Independent Contractors and Employees?

Employees are on payroll, with taxes withheld, and potentially receive benefits like health insurance or paid time off. They typically follow a more structured schedule and use company-provided resources. Independent contractors, however, typically work on a project basis, handle their own taxes and expenses, and don’t receive benefits. While independent contractors can offer flexibility and expertise, they often lack the stability of traditional employment. Worker classifications must comply with applicable laws and regulations. Check out this guide if you’re unsure whether to hire someone as an employee or independent contractor.

-

How Do I Pay an Independent Contractor?

How Do I Pay an Independent Contractor?

Managing paying independent contractors requires a different approach than for W-2 employees. You should consider having a signed contract that outlines payment terms by which you’ll pay them. At the end of the tax year, you’ll also need to complete Form 1099-NEC for each contractor you’ve paid $600 or more during the year. This form is used to report non-employee compensation to the IRS. The 1099-NEC form is different from a W-2. However, it’s crucial to maintain accurate record-keeping and clear communication with contractors to stay compliant.

-

How Do I Onboard Independent Contractors?

How Do I Onboard Independent Contractors?

Onboarding an independent contractor may seem like less work than a traditional employee, but it’s still a process that involves maintaining accurate records and forms for each person. Here’s a brief overview of what to consider:

- Ensure the worker qualifies as an independent contractor by reviewing IRS guidelines and other applicable laws. Misclassification can lead to serious penalties.

- Draft and sign a clear agreement that outlines the scope of work, payment terms, deadlines, and other expectations.

- Request a completed Form W-9 from the contractor to gather their tax identification information. Choosing a payroll provider that also offers onboarding software can help to maintain accurate and current records.

- Establish the payment method and schedule, ensuring it aligns with the contract terms.

-

What Are the Most Common Payment and Tax Mistakes for 1099s?

What Are the Most Common Payment and Tax Mistakes for 1099s?

One of the more common mistakes is misclassifying employees as independent contractors, which can result in significant legal and financial penalties. Another frequent error is failing to issue Form 1099-NEC to contractors who earned $600 or more during the tax year. Improperly tracking payments or neglecting to verify independent contractor tax information can lead to reporting inaccuracies and audits. Staying organized and compliant with federal, state, and local tax regulations is essential to avoid these 1099 mistakes.

Get Started With Paychex Today

Get in Touch Using Our Contact Form

Review Basic Plans and Pricing for Contract Workers