HR and Payroll Services for Nonprofits

Let us help you navigate the complexities of compliance regulations, automate payroll, simplify HR, and more. That way, you can focus first and foremost on your mission.

Tailored Solutions for Nonprofit Organizations

Save Time and Money

We provide easy-to-use software that includes flexible processing, dependable support, and employee self-service tools so nonprofit organizations can spend more time focusing on their mission than payroll.

Build a Team That Stays

Offer a comprehensive benefits package with retirement and health options to help retain staff that are just as mission-driven as you, while also helping improve work/life balance.

Avoid Potential Penalties

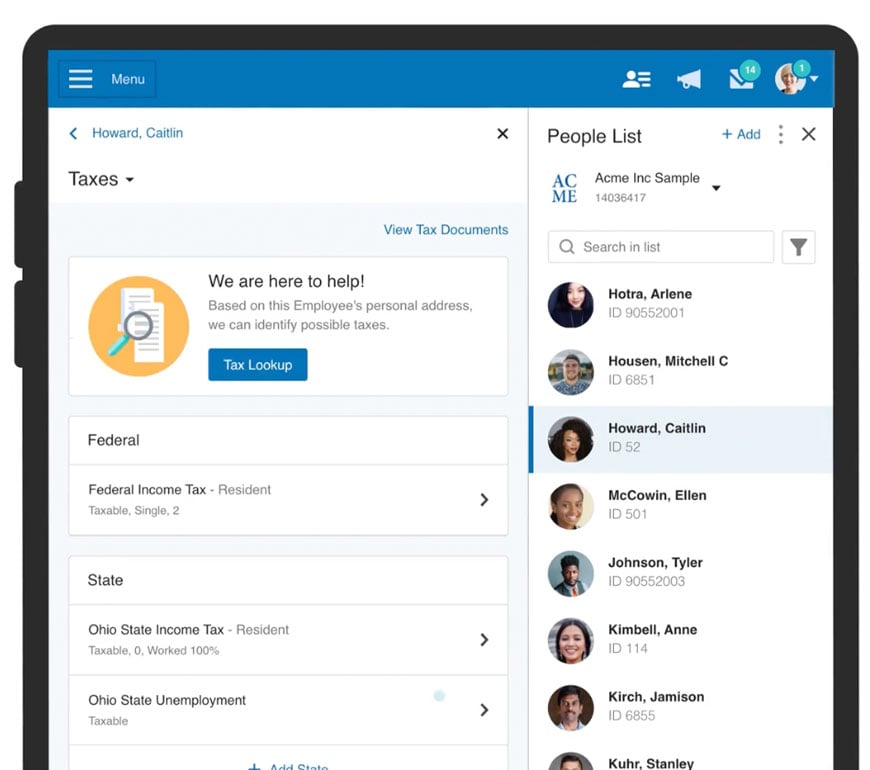

HR software should act as a tool to help you navigate complex tax requirements with ease. Our tax services include automated calculation, filing, and payments to the appropriate agencies.

Stay Informed on Regulations

Our HR resources for nonprofits include tools such as a robust HR Library and employee handbook builder to help you confidently navigate legislative changes and reduce the likelihood of incurring potential fines.

Access Funding

Leverage your non-profit organization’s unpaid invoices to fund essential programs and cover operational costs without delays.

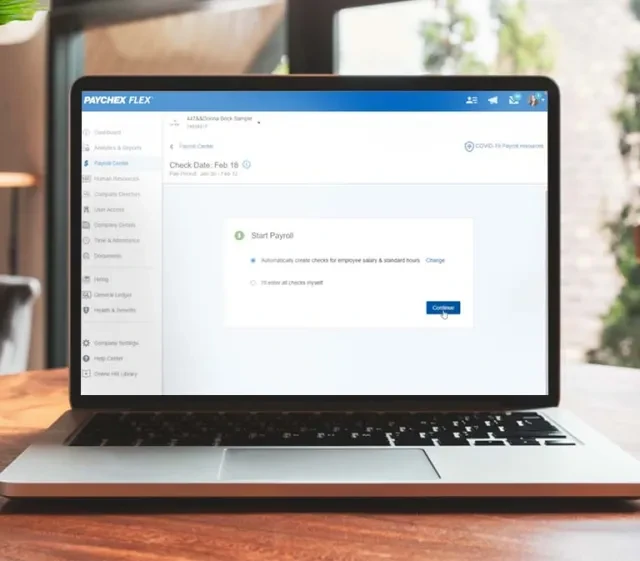

An All-in-One Solution

Our fully integrated HR platform, Paychex Flex, streamlines your payroll, HR, and benefits functions — all in one place. Channel your energy into your mission and volunteer management, not time-consuming administrative tasks that could result in error and burnout.

Compare Payroll Packages

Paychex Flex® Select

Paychex Flex Select provides expert service to match your business needs to our solutions. Process payroll, file taxes online, and have access to online employee training and development with 24/7 support.

Paychex Flex® Pro

Full-service setup, payroll, and tax filing online, plus, additional HR options. For businesses of any size.

Paychex Flex® Enterprise

The complete large business payroll and HR solution that helps you stay compliant, train employees, gain insights through custom analytics, and more.

Custom HR & Payroll Reporting

To help manage funds and resources properly, our payroll services for small nonprofits include customized reporting tools so you can explore trends and visualize your data to make more impactful decisions.

Trust and Integrity Build Community Relations

WXXI Public Media found a resource in Paychex when it came to keeping up with all things HR. Now that WXXI works with a company they can trust, they can put their efforts towards what matters: having a positive impact on their community.

“Payroll, HR, keeping up with the changing IRS rules; these are critical to making our business hum … Not having to invest in the back office means we can put our resources into our core business.”

Getting Started With Us Is Easy

We’ll help pull historical data from your previous system, set up your account, and assist you during your first few payrolls to make sure the transition to us is simple and secure.

Frequently Asked Questions About Payroll & HR for Nonprofits

-

What Does HR Do in a Nonprofit?

What Does HR Do in a Nonprofit?

In a nonprofit, an HR team typically handles the same tasks as any other type of business. These tasks include recruiting and hiring new employees, payroll processing, benefits administration, and more. They also help ensure staff feels supported and aligned with the company’s goals.

-

What Are the Challenges of Nonprofit HR?

What Are the Challenges of Nonprofit HR?

The nonprofit HR sector faces many unique challenges. For instance, these HR teams may have limited resources, support the recruitment of volunteers in addition to employees, and must comply with complex laws and regulations specific to nonprofits.

-

What Does a Nonprofit HR Manager Do?

What Does a Nonprofit HR Manager Do?

A nonprofit HR manager oversees many aspects of human resources within their organization. They help support the mission by making sure the right people, policies, and practices are in place to carry out its work.

-

How Do I Set Up Payroll for a 501c3?

How Do I Set Up Payroll for a 501c3?

To start processing payroll for nonprofits, you may be unsure where to start. The steps below can help you get a feel for what you may need to begin paying employees.

-

Obtain an EIN (Employer Identification Number), which identifies your business for tax purposes.

-

Collect employee information such as names, addresses, social security information, and tax withholding information found on completed W-4s.

-

Determine the payroll schedule and choose the frequency you pay your employees (e.g., weekly, bi-weekly, or monthly).

-

Establish your payroll process so that you have a system in place to record data, streamline your processes, and help reduce errors.

-

Calculate wages and benefits.

-

Calculate and withhold taxes so that the correct amounts are collected, and pay them to the appropriate tax agency.

-

Process payroll and generate paychecks or any other employee pay options.

-

Keep accurate records and maintain details of each payroll run, which helps with compliance and tax reporting efforts.

Consulting with an accountant, human resources professional, or a dedicated payroll provider like Paychex can help tailor advice to your unique business needs.

-