Payroll & Business Tax Services

Keeping up with payroll tax rates, accurately calculating liabilities, and making timely payments can be time-consuming. Take advantage of our automatic online tax administration service, Taxpay®, and get:

- Payroll tax management, including calculation and payment

- Filing of your payroll taxes with your appropriate agencies

- Reduced risk of penalties for late or inaccurate payments

Apply for Potential Tax Credits

Work Opportunity Tax Credit (WOTC)

Hiring from groups that face barriers to employment, such as food stamp recipients, temporary assistance for needy family recipients, and unemployed veterans, can make you eligible for federal and state tax credits ranging from $1,200 to $9,600 per eligible employee. We’ll help you apply for the WOTC:

- Applicant eligibility verification and screening via paper, phone, or web

- Preparation and filing of applicant pre-screening forms

- Tracking of hours worked and wages paid

- Quarterly and annual reports showing credits you’ve earned

Location-Based Credits

To encourage economic development in select areas of the U.S., the government has established tax credits available to qualified business owners. Credits can total as much as $3,000 per qualified employee per year, which you can use to reduce your federal income liability. We’ll help you apply for location-based credits:

- Documenting address changes, hours worked, and wages and credits earned for qualified employees

- A comprehensive year-end report for easy preparation of tax returns

- Maintaining documentation and an audit trail for seven years

- Tracking changes to legislation and regulations to help your credits stay in compliance

Research & Development (R&D) Tax Credit

Changes to your design or development processes to make them cheaper, greener, or faster could earn you tax credits. The R&D Tax Credit can be applied to new product development, manufacturing, and software development production. Industries likely to qualify for this tax credit:

- Manufacturing and fabrication

- Engineering

- Construction

- Software development

- Electronics

- Biotechnology

- Surgical techniques

- Oilfield services

- Food sciences

- Agriculture

Other Types of Tax Credits

Paychex Tax Credit Services can also assist with:

- Research and Development Wage-Based Credit

- Cost segregation

- Training incentives

- State tax credits

- Domestic production deduction

Employee Retention Tax Credit (ERTC)

The Employee Retention Tax Credit (ERTC) is a refundable credit businesses can claim on qualified wages, including certain health insurance costs, paid to employees. Businesses have until April 15, 2025, to file amended returns for the quarters in 2021 in which they were eligible for the ERTC. For most businesses, this credit can be claimed on wages paid between March 12, 2020 until Sept. 30, 2021. Here’s how our ERTC Service can help:

- We are one of the only providers offering ERTC Service

- Switch to Paychex as your payroll provider and we’ll provide a questionnaire to help you determine your ERTC eligibility

Working With Paychex Has Its Benefits

Claim Tax Credits without the Hassle

Applying for tax credits can be complicated and time-consuming. We make it easy by taking care of the rigorous requirements.

Stay Compliant

We’ll create a well-documented and legally compliant audit trail to help you claim your credits.

Only Pay for Tax Credits Found

This service is completely free for Paychex clients. You only pay a fee when we find credits.

Multi-State Compliance

Multi-state payroll taxes are complex. However, Paychex can assist with all payroll administration and payroll tax needs, regardless of employee location.

You may need payroll tax management services if:

- You have remote employees or employees working across state lines

- You need ongoing payroll tax management support as your business expands

- You want to reduce the risk of tax mistakes and keep your business compliant

Do More With Paychex Tax Services

Paychex Taxpay® makes it easier to avoid tax penalties and our tax credit services help you save money by helping you find tax credits so you can focus on taking your business further.

Seasonal Business Gets Year-Round Service To Meet Its Tax Requirements

As a seasonal business, Super Seal Sealcoating Company owner Greg Duffy has been using a seasonal hold through Paychex for 35 years, suspending his payroll service in the off-season while still supplying W-2s to his employees.

"Having a seasonal business ... (a seasonal hold) is a beautiful fit. I tell them in October, there's a small charge to do my quarterlies over the winter and do my W-2s. Then come April, (Paychex) says, "Greg, are you ready to come back.' "

Business Owner Finds a Service to Help Remove a Taxing Burden

Jonathan Kirkendall tried to do it all himself and handle his own taxes — and every year for more than 20 years, he owed and had fallen behind. In his first full year using Paychex services, the licensed psychotherapist got a refund that helped get him back on track.

“I was looking for a (payroll provider) who could help me very specifically with quarterly taxes. … I had fallen behind. I just needed some regular help because working with an accountant once a year wasn’t enough. … (Working with Paychex) has been peace of mind. … I’m getting a refund this year and … that’s amazing.”

Other Products To Consider

In addition to helping you with your payroll and business taxes, consider other solutions designed to simplify your business challenges.

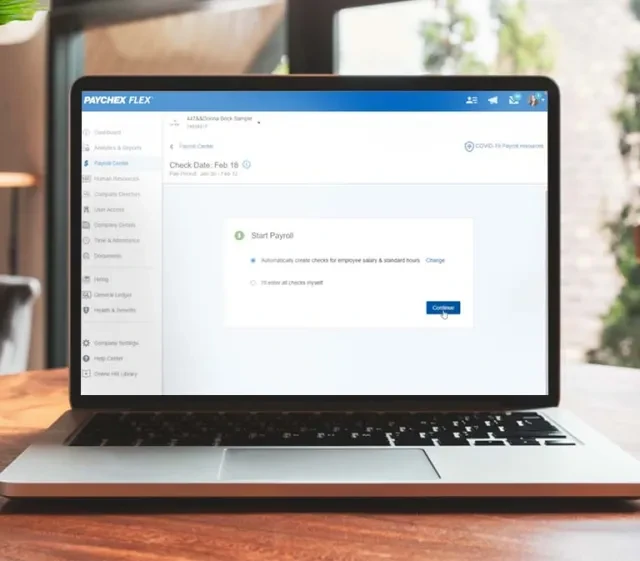

Simplify Payroll, From Setup To Service and Support

Run your business the way you want to. Compare and choose the best payroll solution that meets the needs of your company and your employees.

Support From Our SUI Specialists

Mandatory insurance such as SUI can be complicated, and penalties can cost you more than just time and effort. Our SUI service works hand-in-hand with Paychex payroll to help reduce the administration and costs commonly associated with unemployment insurance.

Peace of Mind for Your Business

With Payroll Protection, we provide you the flexibility to extend the collection of payroll funds from your bank account by up to seven days without interruption of services or insufficient fund charges to help clients better manage their cash flow and withstand temporary cash flow issues.1

Fortune-500 Level Offerings

Attract and retain talent by creating a competitive employee benefits package, and easily manage your company’s group health insurance, section 125 plans, retirement, and other employee benefits.

Payroll Tax Services FAQs

-

What Are Payroll Tax Expenses?

What Are Payroll Tax Expenses?

Payroll tax expenses are the expenses a business must pay when they hire employees. This would include any withholdings or deductions like those associated with Federal and State Income taxes, State or Federal Insurance Contributions Acts (FICA) taxes.

-

Does Paychex File Payroll Tax Returns?

Does Paychex File Payroll Tax Returns?

Yes, for companies looking to outsource their payroll, Paychex can help file payroll taxes on behalf of the employer.

-

Who Sends the Employee’s Payroll Taxes?

Who Sends the Employee’s Payroll Taxes?

Employers generally deposit employment taxes and report them according to set deadlines.

-

How Do I Get My Tax Form From Paychex?

How Do I Get My Tax Form From Paychex?

Paychex clients can log in to Paychex Flex® and under “Tax Documents” you will have the option to download your W-2 or 1099.

-

How Do I Manage Multi-State Payroll Taxes?

How Do I Manage Multi-State Payroll Taxes?

If your business employs remote workers or staff in multiple states, you’ll need to register with tax authorities in each state where your team is located. This can feel overwhelming, but Paychex is here to simplify multi-state payroll taxes and help you stay on top of payroll administration and compliance.