Programa de Protección de Cheques de Pago de Paycheck: la nueva ley extiende y amplía el programa, pero afecta la condonación

- COVID-19

- Guía

-

Last Updated: 03/10/2021

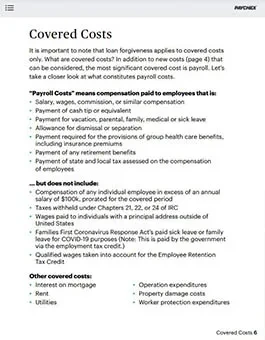

The Consolidated Appropriations Act, 2021 expanded and extended the Paycheck Protection Program (PPP) and its benefits. The program’s goal remains the same: help employers retain/pay employees or bring back those let go, provide funds to assist with covered operating costs and make loans forgivable on eligible costs in the coverage period.

Hardest-hit and smaller businesses could even take out a second-draw PPP loan and claim the Employee Retention Tax Credit, while access to alternative funding also is available.

In this guide, we give you information on:

- What's changed with PPP including the availability of second draw PPP loans and expansion of covered costs

- Loan forgiveness eligibility