Paychex HR and Payroll Services in Maine

As a leader in HR and payroll, Paychex uses its expertise and technology to save Maine businesses time, enhance payroll accuracy, and eliminate HR inefficiencies.

Get a Free Quote

Paychex Maine Locations

Our office in Auburn, just inland from Maine’s rocky coastline, serves businesses across the state. From breweries to boutiques and lumber mills to lobster shacks, we proudly give Maine business owners and managers reliable HR and payroll services that free them from administrative duties letting them focus on their business needs.

Paychex Services for Maine Businesses

Manage Your Employees and More

Whether seeking help with a few everyday HR tasks or completely outsourcing HR administrative tasks to a PEO*, Paychex has solutions to help your business save time and money so you can focus on what matters most.

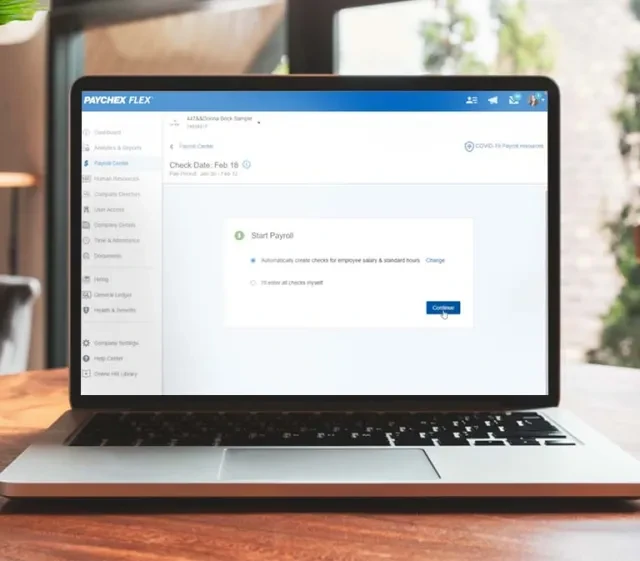

Make Payroll Easy, From Setup to Service and Support

Our award-winning easy online payroll software allows Maine businesses to:

- Pay their team with just a few clicks

- Enjoy flexible processing and automated tax administration

- Empower employees with self-service options

One Stop for Business Insurance Service and Support

Why choose Paychex for business insurance? The answer is simple:

- Top 100 insurance agency – 5 years in a row**

- 20+ years experience

- 150,000+ customers throughout the U.S.

- Wide range of options, from cyber liability to workers’ compensation and property insurance

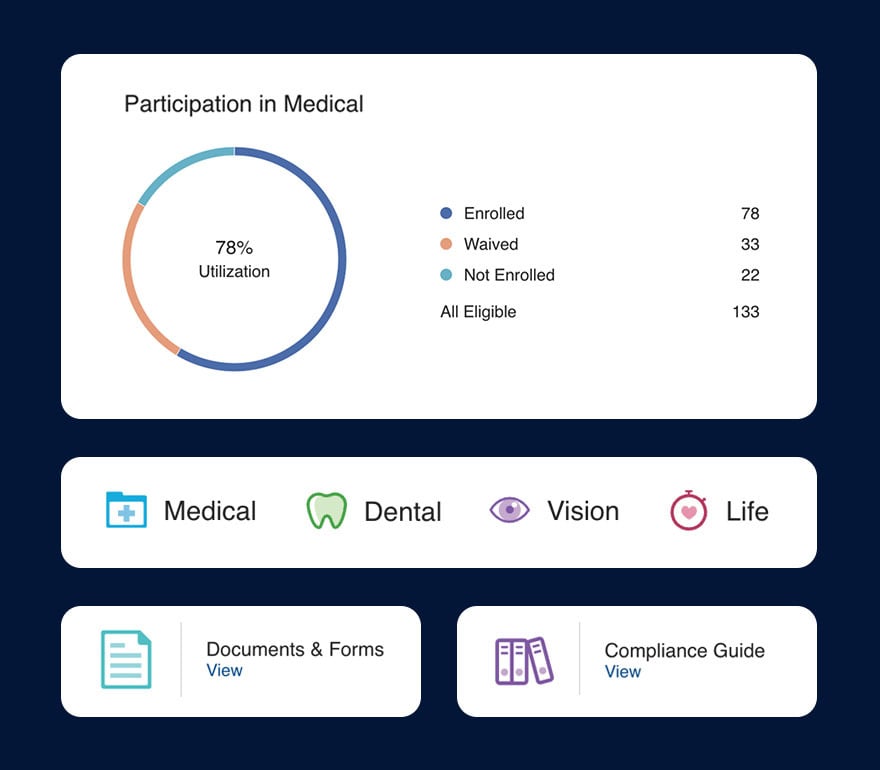

Support Your Employees With Better Benefits

Attract and retain top talent with Paychex’s cost-effective, comprehensive benefits package options. Streamline HR admin with seamless online management.

The Single Platform for your HR, Payroll and Benefits

Our Paychex Flex® platform caters to businesses of all sizes, providing tailored solutions for HR and payroll needs. Enjoy over 30 self-service actions for employee convenience, award-winning technology and support, robust data-driven reporting and analytics, and a system that never requires migration.

Contact a Paychex Payroll & HR Consultant

Paychex’s experienced customer service representatives are ready to help Maine businesses with questions they may have. Our HR professionals have extensive knowledge of Maine and federal laws and regulations.

Convenient Service

Maine businesses can reduce time spent on HR administrative tasks by working with Paychex. We help make managing your payroll, HR, and benefits more convenient with our all-in-one award-winning software.

Need support? We're here to help.

Find the Right Solution for Your Business

Our technology, expertise, and customer service can help move your business forward. Find the solution that best suits your individual business needs.

Paychex Is the Smart Choice for Payroll and HR Services in Maine

- Largest HR company for small to medium-sized businesses

- Pays 1 in 12 private sector employees

- HR professionals averaging 8 years of training and expertise

Additional Resources for Businesses in Maine

What Is Workforce Management and How Can WFM Software Benefit Companies?

HCM

•

Article

•

6 min. Read

Payroll Solutions for Businesses of Every Size

Paychex Payroll Services can help you achieve your business goals by saving you time and money. Hear from our customers about why they choose Paychex to help ease the burden of payroll.

"The daily time that I don’t spend on (payroll) … it really changes my daily routine. It allows me to make phone calls, answer emails, talk with general contractors and talk with my franchise (personnel). Having the ability to do that streamlines both processes."

"When I first started, my wife used to do my payroll for me, but it didn't always work out because I'm too busy, she's too busy ... so her brother, who's a CPA, suggested that I should use Paychex. Having Paychex as my payroll service just makes my life a lot easier."

“For me and my business, Paychex is someone that I can depend on to make sure that every person is paid on time.”

“When we acquire a new community, continuity in the team members is very critical to the residents, so it’s very critical for us to ensure … all these team members are enrolled in a payroll system, signed up for their benefits, get their 401(k).”