- Nueva empresa

- Artículo

- Lectura de 6 minutos

- Last Updated: 05/03/2017

The Best Small Businesses: Analyzing the Inc. Annual 5000 List

Table of Contents

Cataloged yearly in the Inc. 5000 List of America's Fastest-Growing Private Companies, American businesses are profiled for their entrepreneurial excellence. Whether they have one or thousands of employees, these organizations are shining examples for “wantrepreneurs” – those who continue to sit on the sidelines, unconvinced they can pen the next great American business success story.

These 5,000 businesses may not be involved in many of the same industries, but one thing they have in common is their success. We examined data to understand the significant trends of these fast-growing businesses, especially those with less than 500 employees. What are they doing differently to see this growth? What industries are they thriving in? Where are they located? Are certain industries more popular in different regions? Here’s all you need to know about these relatively small companies to potentially fuel your business or organization and join their ranks.

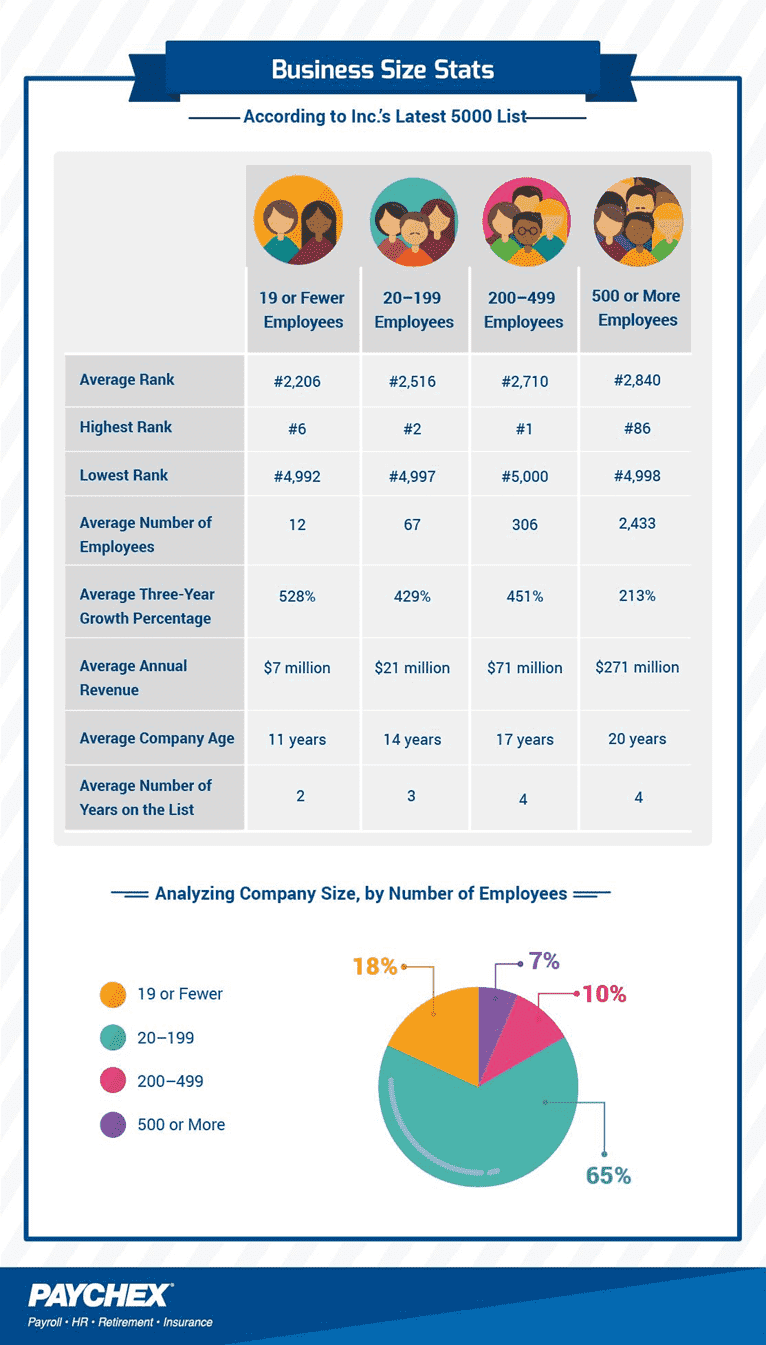

Companies can be successful at any size, whether business owners employ close friends or family, a few hundred acquaintances, or an army of thousands in pursuit of a shared goal. To look at different business sizes more closely, we first analyzed those with 19 or fewer employees, 20 to 199 employees, 200 to 499 employees, or 500 or more employees. It turns out, 65 percent of businesses on the list had 20 to 199 employees, with an average team size just under 70 employees.

Companies classified as micro had the highest average rank, just below No. 2,200. FedBiz IT Solutions, in the government services industry, is an example, ranking No. 10 overall and witnessing a three-year growth of over 12,000 percent and nearly $26 million in annual revenue.

While the smallest businesses claimed the largest average three-year growth percentage (over 500 percent), businesses with 200-499 employees weren’t worse for wear, averaging an over 450 percent increase in the same timeframe. This may be buoyed by the success of the No. 1 company on the Inc. 5000, Loot Crate, which has seen its revenue skyrocket to over $116 million. Their three-year growth percentage of over 66,000 percent speaks to their ability to generate over 600,000 paid subscribers of their monthly goodie boxes.

There are top industries for different sizes of businesses. More than any other industry, companies with 19 or fewer employees were involved in the Business Products and Services industry. This is different than businesses with 20 to 199 employees, where most focused on IT Services. Organizations with 200 to 499 employees specialized in the Health industry above all else.

Two industries that greatly attracted entrepreneurs and owners of differently sized businesses were Business Products and Services, and IT Services. These were in the top three most popular industries for each company size. Advertising and Marketing was also in the top two for businesses with 199 or fewer employees.

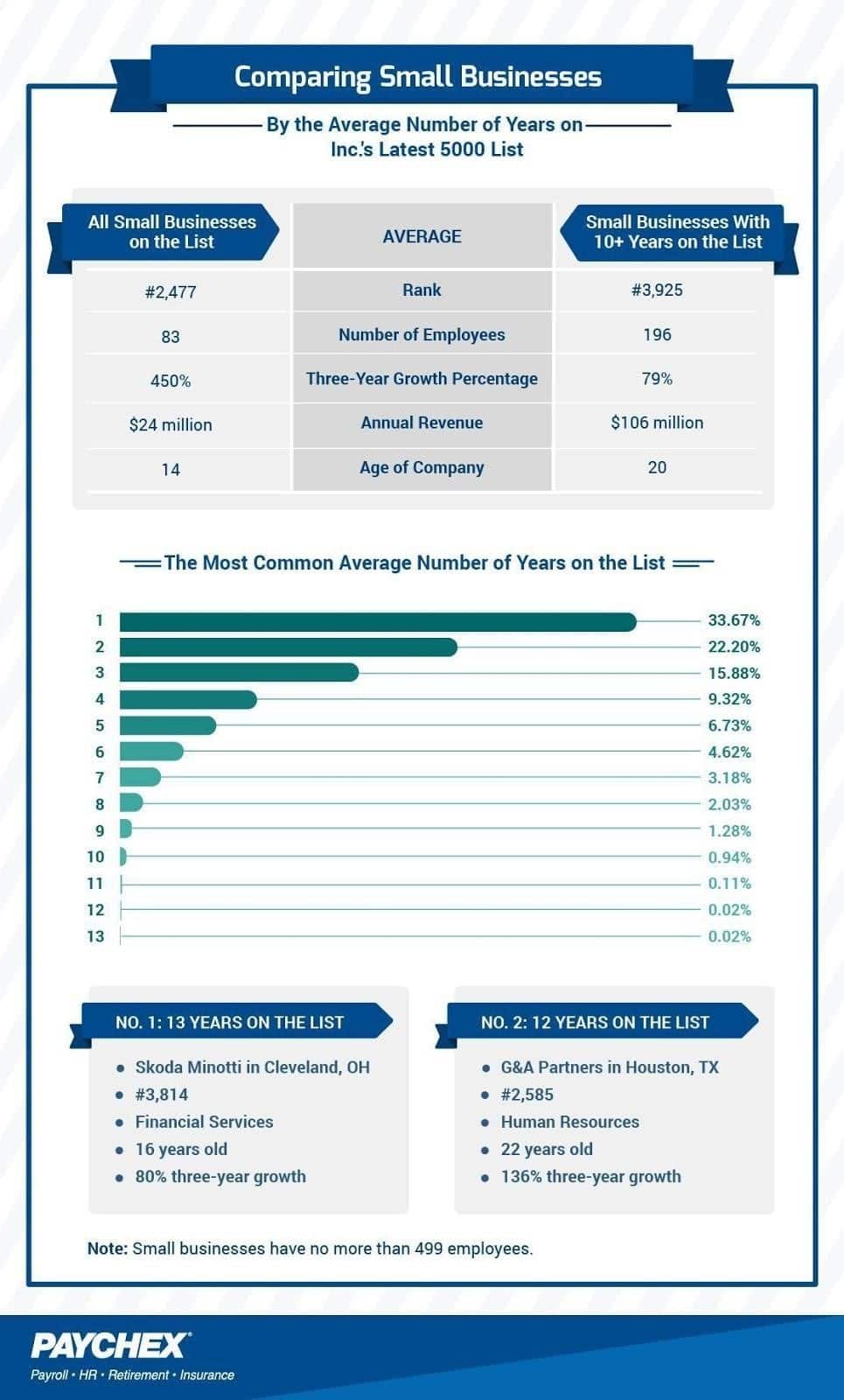

Over 30 percent of small businesses on the Inc. 5000 list are making their first appearance this year, while more than 70 percent of small businesses have been featured one, two, or three years total. Continuing to grow at such a fast rate each year is proving to be a challenge. Just over one percent of small companies on the list have been featured 10 or more years.

Small businesses that have been on the Inc. 5000 list for 10 or more years – in comparison to all small businesses included on the list – have a bit of a different look. On average, they employ over 100 more employees and earn over $80 million more in annual revenue.

However, where they lag behind is in the three-year growth percentage. While an average small-sized business on the Inc. 5000 list saw a 450 percent increase, small businesses on the list for 10 or more years had less than an 80 percent growth during the same period.

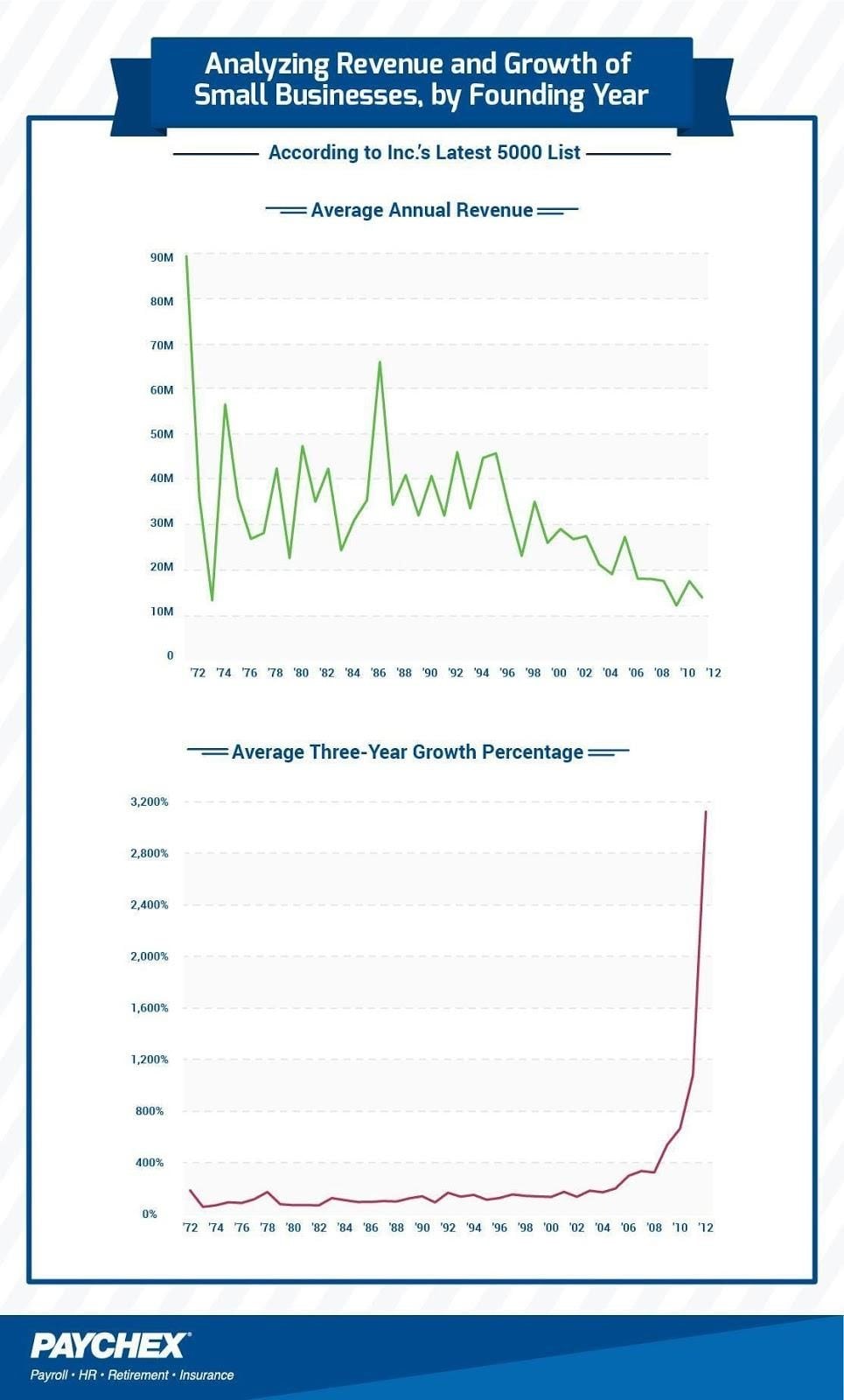

Great growth over a three-year period doesn’t mean small businesses have the largest overall annual revenues. In fact, while the average three-year growth of a company founded in 2012 on the Inc. 5000 list saw an increase of over 3,000 percent, the average annual revenue was just over $13.5 million. This was the highest growth average, but the third lowest average annual revenue based on shared founding dates. Of course, there are always exceptions such as the No. 3 company, CalCom Solar, which since its founding in 2012 saw a three-year growth of over 31,000 percent and annual revenue of $33.5 million in 2015.

This also doesn’t exclude older companies from seeing significant three-year growth on small profits, compared to some businesses on the list. Ranked No. 98, CATMEDIA launched in 1997 and saw a three-year growth of over 3,300 percent and over $17 million in annual revenue in 2015. They significantly outperformed the average three-year growth of companies founded in 1997, just shy of 160 percent, but underperformed against the average 2015 annual revenue of over $33 million.

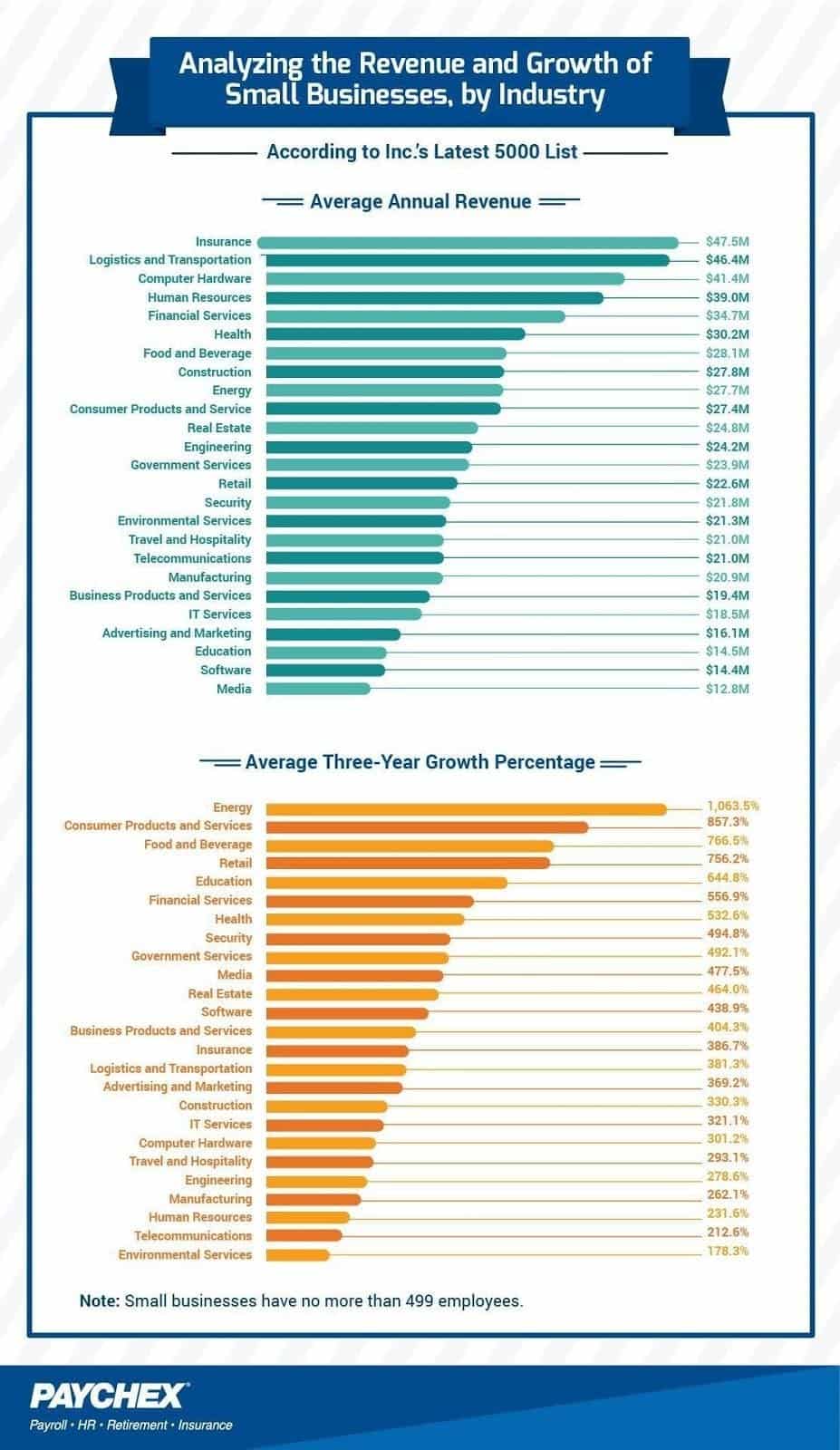

A supercharged three-year growth is happening in the energy industry as companies in this field on the Inc. 5000 list saw an over 1,000 percent increase from 2012 to 2015. Six of the top 100 companies are in this field – CalCom Solar, Legend Solar, Greenspire, LA Solar Group, Discount Power, and Lead Genesis – with five being involved in green energy solutions, such as solar. While these companies are achieving the highest growth percentage, their average combined annual revenue ranked ninth, just shy of $28 million in 2015.

Companies in the Food and Beverage industry ranked No. 3 in a three-year growth period, at over 760 percent, and seventh for average annual revenue in 2015 with over $28 million. Seven of the top 100 businesses operate in this space. Suja Juice, ranked No. 13 overall, holds the highest spot with a three-year growth of over 10,000 percent and annual revenue well above the industry average, nearly $66 million. Their revenue helped to buoy some of the smaller earners, such as Remarkable Liquids and Chef’s Cut Real Jerky, both in the top 100 but with a 2015 annual revenue of just under $7.5 million each.

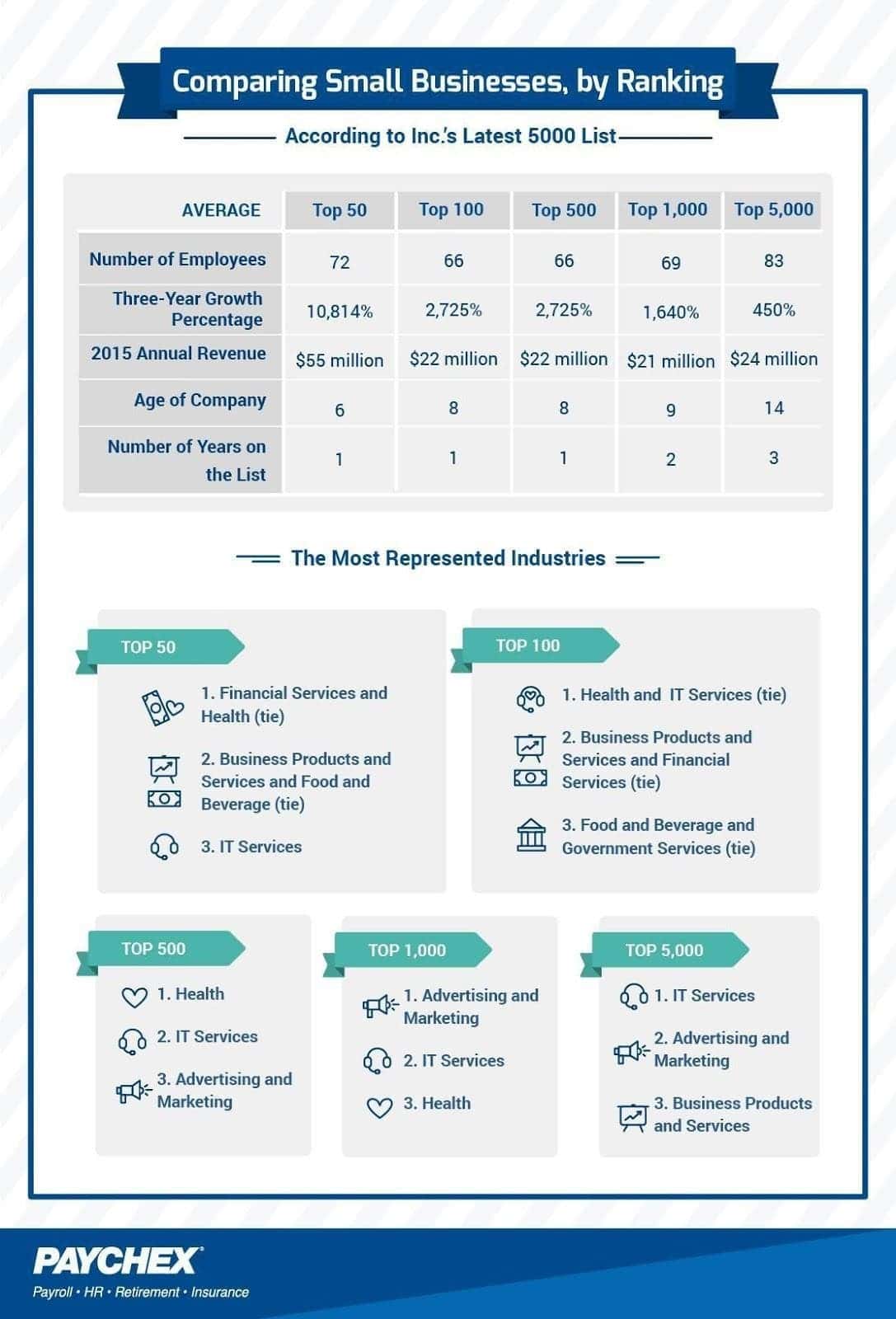

The small businesses on the Inc. 5000 list averaged over 80 employees and had an average 2015 annual revenue of $24 million. They also averaged almost 15 years in the business and three years on the list. This is in contrast to the top 50 that ran smaller businesses with about 10 fewer employees on average. But this didn’t hamper their earnings, as they averaged over $50 million more in 2015. These are younger companies, with an average of six years in business and only one appearance on the list.

There were several common industries across these groupings. In the top 50, 100, and 500, companies in the Health sector were first or tied for first with the largest number of businesses involved in these fields. IT Services also appeared across all lists – it was the No. 1 most represented industry on the entire 5,000 list but No. 3 overall among the top 50.

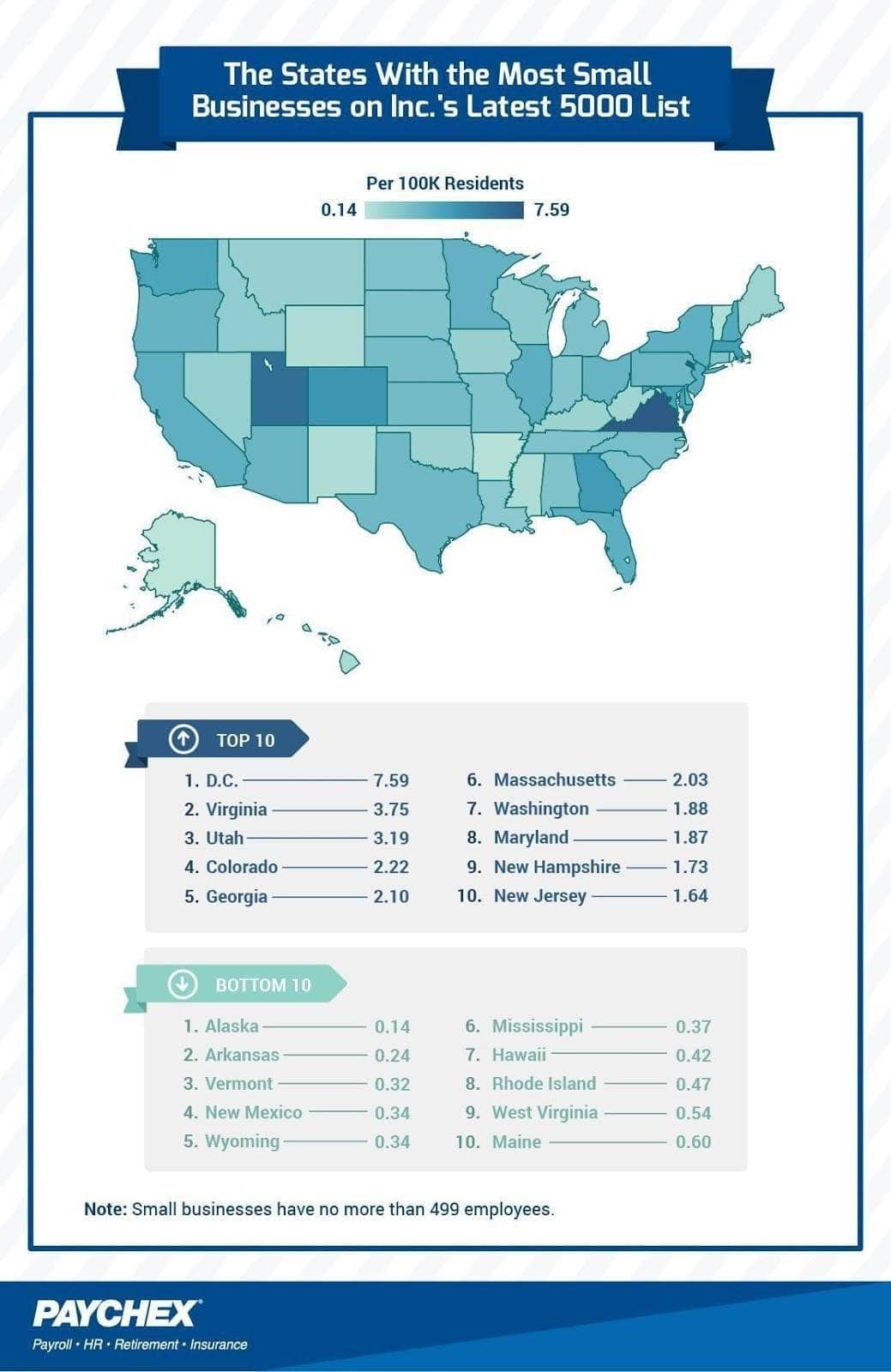

Per 100,000 residents, Washington, D.C. had the most small businesses featured on the Inc. 5000 list. This included companies like SJ Technologies in IT Services, with a three-year growth of over 3,800 percent and a 2015 annual revenue of $14.5 million. They ranked No. 78 overall. There were also several companies involved in Government Services, which should be no surprise given the movers and shakers of the U.S. political system that call the nation’s capital home.

On the flip side, Alaska and Arkansas were two of the most poorly represented states. In fact, Airframes Alaska, the only company from The Last Frontier, has been on the list two years in a row. They ranked No. 2,046 in 2016, which was down from their inclusion in the top 1,000 in 2015 at No. 670. Arkansas fared a little better, with eight businesses making the list and two in the top 1,000. Both of these companies, Team SI and Collective Bias, are in the Advertising and Marketing industry.

In the Northeast, Midwest, and South, IT Services companies dominate. They’re No. 1 in each of these regions for the number of companies on the Inc. 5000 list. While Advertising and Marketing was No. 2 in the Northeast and Midwest, the South deviated with Government Services.

The makeup of the top five industries in the West had a different look. Advertising and Marketing was the best-represented industry on the list. Consumer Products and Services, which was the fifth most represented by companies on the list, was only featured in the West. This area features heavyweights such as the Dollar Shave Club, who posted a three-year growth of over 4,100 percent and a 2015 annual revenue of over $150 million.

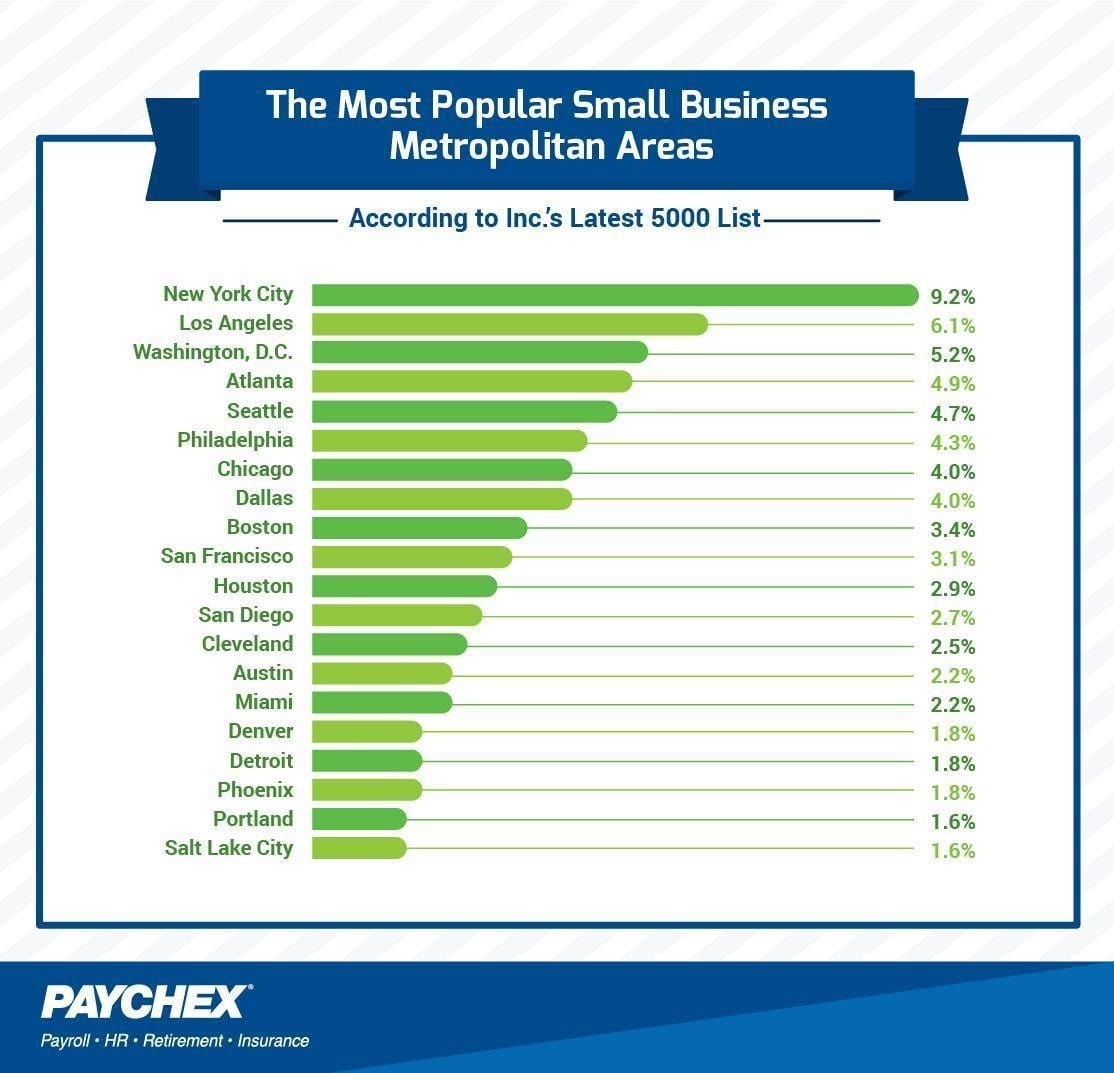

New York City is the most well-represented of the major metropolitan areas across small businesses on the Inc. 5000 list. Over nine percent of small businesses on the list call the Big Apple home. Highest on the list from NYC, Bounce Exchange has seen a three-year growth of over 14,000 percent and a 2015 annual revenue of almost $16 million. Overall, ten companies from the New York City metropolitan area appear in the top 100.

Featuring the second largest number of businesses included in the Inc. 5000 list, Los Angeles serves as the staging area for over six percent of small businesses. L.A. actually hosts more members of the top 100 than New York City – 12 to 10 – and several with incredible growth. Los York Content, an Advertising and Marketing company, ranked No. 8 overall and saw a three-year growth of over 14,000 percent and over $15 million in annual revenue in 2015.

Small Business Power

It doesn’t matter what industry or city your small business is based in – there are success stories featured across the entire United States. Whether you’ve seen a three-year growth of 10 percent, 100 percent, or even 1,000 percent or a yearly revenue in the millions, small businesses are finding ways to be successful in almost every industry imaginable.

Make it easier to focus on creating the most successful enterprise possible by leaving the payroll, HR, and benefits management to Paychex. To learn more, visit Paychex.com.

Methodology

We analyzed Inc.’s annual 5000 list to identify small business trends.

Tags