Voluntary Benefits Solutions and Insurance Plans

Offering dental and vision insurance, as well as other voluntary benefits with the help of the Paychex Insurance Agency, can:

- Boost your workforce’s benefits package

- Help control rising healthcare costs

- Assist in amping up employee retention

Voluntary Benefits Insurance Options

Group Dental Plans

Paychex Insurance Agency works with carriers nationwide to offer dental plans to help your employees save on dental healthcare costs.

Group Vision Plans

Add a voluntary vision plan to your employee benefits package to help cover optometrist visits, glasses, contact lenses, and qualified over-the-counter vision care expenses.

Employee Accidental Death and Dismemberment Plans

In the event of the unthinkable, it’s important to have coverage that protects your employees and their families so that money doesn’t become another burden on those affected.

Short- and Long-Term Disability Plans

Help employees replace lost income from a covered short-term and long-term disability that prevents employees from performing regular work duties.

Life Insurance

Life insurance pays benefits to an employee’s beneficiaries upon their death, helping to ease financial burdens such as paying taxes or final expenses and leaving a legacy for their families.

Affordable Benefits and Discounts

Offer employees access to additional benefits and discounts to meet their ever-changing needs at no cost to you. Paychex Flex® Perks include pet insurance, accidental injury, critical illness insurance, and more.

Let Us Help Find the Right Solution for You

Simplify Plan Management With Our Help

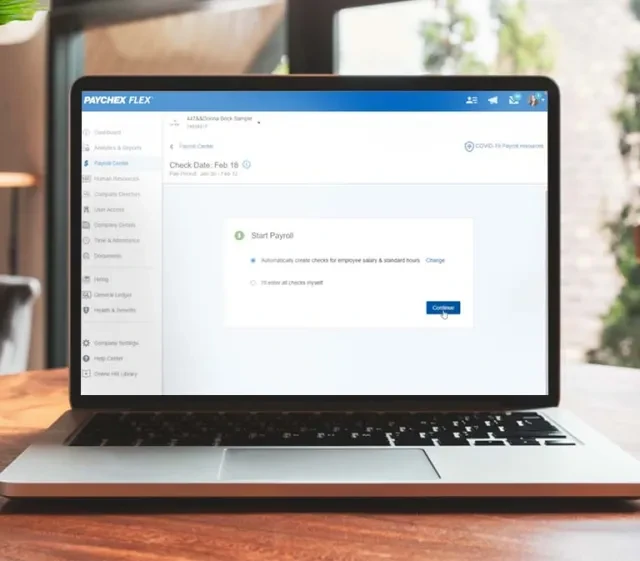

Voluntary insurance plans seamlessly integrate with our payroll technology, Paychex Flex®, allowing a smooth data transfer between payroll and benefits. We simplify plan management, allowing you to automatically deduct premiums from Paychex payroll with a single employee record.

Advantages for Employers

Adding voluntary benefits to your plan offerings can:

- Reinforce a strong brand image with the commitment to an employee’s work/life balance

- Create more productive and motivated employees

- Serve as an attracting and retaining tool

Advantages for Employees

Using voluntary benefits can help employees:

- Access services or programs that otherwise wouldn’t be available

- Address unique needs through flexible options

- Save money while improving their quality of life

Other Paychex Products To Consider

In addition to a voluntary insurance plan, Paychex offers a wide range of solutions designed to help simplify your complex business needs.

Frequently Asked Questions

-

What Are Voluntary Benefits?

What Are Voluntary Benefits?

Voluntary benefits are additional insurance offerings that employees can choose to add to their workplace benefits package. Typically, a voluntary benefits plan is funded by the employee.

-

Why Are Voluntary Benefits Important?

Why Are Voluntary Benefits Important?

Voluntary benefits allow employers to offer benefits that help attract employees without the added cost to the business, and they can reduce your tax bill. Learn more about individual benefits vs. voluntary benefits.

-

What Are Some Examples of Voluntary Benefits?

What Are Some Examples of Voluntary Benefits?

A voluntary benefits program can include some or all of the following coverage types:

- Short- and long-term disability insurance: This insurance can replace part of an employee’s income for several weeks or months in the event of an injury or disability that prevents them from resuming normal work duties.

- Life insurance: Provides a large financial payout to a named beneficiary upon the death of the insured.

- Dental and vision insurance: As two of the most popular options, a voluntary benefits plan dental package or vision package will provide coverage for specific and limited dental and vision visits, preventive dental and vision exams, services, glasses, and contacts.

- Hospital indemnity and critical illness: Protects against large financial burdens due to costly medical diagnoses or treatments.

Other voluntary benefits examples include the likes of pet insurance, tuition assistance, and telehealth access. Benefits providers can help customize these offerings to fit your needs.

-

Can Voluntary Benefits Be Pre-Taxed?

Can Voluntary Benefits Be Pre-Taxed?

Some voluntary benefits may be set up to deduct premiums from an employee’s paycheck before taxes are taken out – in other words, pretax. This provides the benefit of effectively reducing the employee’s taxable pay and saving them on federal and state taxes.

-

Are Fringe Benefits the Same As Voluntary Benefits?

Are Fringe Benefits the Same As Voluntary Benefits?

While “fringe benefits” and “voluntary benefits” are often used interchangeably, they refer to slightly different things. Fringe benefits are typically a term for a broader set of non-wage compensation, such as health insurance or paid leave. Voluntary benefits usually refer to added perks or options that employees choose to participate in, such as vision or dental care.