- Payroll

- Article

- 6 min. Read

- Last Updated: 01/02/2025

An Employer's Guide to Giving Pay Raises for Inflation

Table of Contents

As businesses gain momentum into 2025, one of the most pressing decisions facing employers is how to approach pay raises amid ongoing inflation concerns. Pay raises often reward employee performance and contributions while helping a business compete for talent in the broader market. But offering inflation-based raises has taken on new importance as employees struggle to maintain their purchasing power.

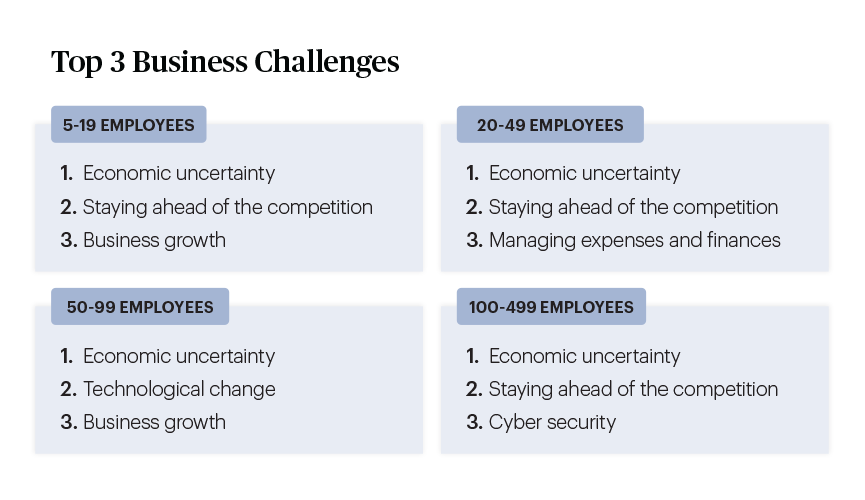

Business leaders told us in Paychex's 2025 Priorities for Business Leaders survey that they are struggling with financial issues, and the results are worse than last year. The impact is significant for businesses of all sizes, with 86% of leaders now seeing economic uncertainty as their top challenge, up dramatically from 60% in 2024. This sharp increase may reflect growing concerns about managing business costs, which can be affected by pay adjustments.1

Inflation and pay increases can sometimes be related, but different factors drive them. Inflation is a measure of the rising cost of essential goods like housing and groceries, while pay increases may depend on legal requirements or the balance between the number of people looking for work and the available jobs — typically related to labor supply and demand. So, the big question on many employers' and employees' minds is, “How will wages be adjusted for inflation?”

How Does Inflation Affect Employee Wages?

Although the rate of inflation is slowing down, wages and other forms of income have not yet caught up. According to the Bureau of Labor Statistics (BLS), the inflation rate was 4.1% in 2023 and 2.9% in 2024. This ongoing inflation continues to affect both business operations and employee financial well-being. While lower than recent peaks, these rates still exceed the pre-2021 benchmark of 2%, creating ongoing compensation challenges.

The relationship between an employee's wages and inflation is straightforward but critical: when inflation outpaces wage growth, employees experience a reduction in buying power. To illustrate, if inflation climbs to 8% while your pay remains the same, employees lose 8% of their purchasing power. This creates pressure on household budgets and can impact employee satisfaction and retention. Every dollar spent to counter the surge in purchase costs represents a dollar that could have otherwise been allocated to savings or other expenses.

Many employees are urging their employers to raise wages to cope with the rising cost of living. While most organizations acknowledge inflation's effect on wages, the challenge is to find the right balance between maintaining competitive compensation and managing overall business costs.

Wages vs. Inflation

Inflation has been outpacing wages for several years, but the tide may be turning. According to BLS data released in late November 2024, average hourly wage growth has exceeded inflation. This marks a notable change from previous years. The gap between wage growth and inflation was at its widest in the third quarter of 2022; prices had jumped 12.8% since the start of 2021, while wages had climbed a smaller 9.1%, a 3.7-point gap.

Making changes to employee compensation? Ensure your payroll is accurate and on time, every time.

Should Companies Give Inflation-Based Pay Raises?

Offering an inflation-based pay increase is worth considering as a retention tool. A cost-of-living raise for employees isn't based on job performance or a promotion. Instead, an increase is given to counteract the rising cost of living and help employees maintain their earning power.

Without cost-of-living adjustments that keep pace with inflation, employees may find their standard of living declining as they struggle to manage rising prices for basic staples such as housing, energy, and food. This situation can often lead them to explore opportunities elsewhere.

Pay increases for inflation can help foster employee retention and loyalty, but simply matching market trends may not be enough to maintain employee satisfaction and prevent turnover.

According to a December 2024 report by the Pew Research Center, only 30% of employees express high satisfaction with their compensation, down from 34% the previous year. “This trend is significant for HR professionals to monitor, especially as employees increasingly feel that their pay does not adequately reflect the quality and quantity of their work. Addressing these concerns could be crucial for maintaining employee morale and retention,” according to Amanda Gee, Talent Enablement Partner at Paychex.

“Additionally, more than half of the employees surveyed reported feeling a great deal or a fair amount of job security. However, this does not necessarily translate to satisfaction or engagement. Notably, 31% of workers aged 30 to 49 and 38% of workers aged 18 to 29 view their jobs merely as a means to get by.

“Employers should prioritize workforce planning to identify employees at risk of turnover and assess the potential impact of their departure on operations and revenue. This proactive approach can help mitigate risks and ensure organizational stability.”

Are Inflation-Based Pay Raises Mandatory

Government contracts and certain collective bargaining agreements may include inflation-based pay adjustment requirements. Additionally, numerous minimum wage and salary threshold requirements are now based on inflation.

Businesses facing financial challenges may struggle to offer raises during tough years. If you decide against wage increases, it's crucial to communicate with your employees and explain the reasons behind your decision. To prevent a high turnover rate, which can be costly for your business in the long term, explore other means to retain valuable employees, such as:

- One-time bonuses or stipends to help with immediate cost pressures

- Improved benefits package, focusing on high-impact areas like healthcare contributions or retirement matching

- Flexible work arrangements that can help reduce employee commuting

Taking a proactive approach to compensation and benefits can help address employees' cost-of-living concerns even when traditional raises aren't possible. This strategy may help maintain employee engagement while protecting your business's financial stability.

“When conducting workforce planning, it is essential to identify the underlying reasons for employee disengagement and higher turnover rates compared to industry norms. Understanding these root causes is critical. A common issue is that employees often feel underpaid relative to their work or market standards. By reviewing and adjusting compensation structures, including base pay, bonuses, and benefits, organizations can address this concern and improve overall employee satisfaction.”

“Consulting with our Human Resources Professionals can help ensure that compensation strategies are aligned with employee expectations and market trends, fostering a more engaged and stable workforce,” says Gee.

How Much Should Wages Increase With Inflation?

The annual cost of living adjustment (COLA) established by the Social Security Administration can guide you toward how much of a raise is needed to keep up with inflation. In 2024, the Social Security COLA was 2.5%, which is a decline compared to the COLAs in recent years.

However, due to the rising cost of living and inflation, the usual annual wage hikes might not allow employees to live comfortably or feel adequately rewarded for their work. To determine the right wage increase for your employees in 2025, consider factors like applicable legal requirements along with your company's revenue.

Some employers give more significant raises to exceptional employees to retain them while providing standard raises to the rest of the workforce. This approach may help maximize your budget and encourage better performance and productivity.

How To Calculate a Pay Increase Based on Inflation

There are several factors to be aware of when considering how to adjust pay for inflation. Calculate a standard base pay and take into account any of these potential wage increases to shape a total compensation package.

- Inflation: Understanding inflation in your relevant economy is essential. Assess movements over multiple years, as price changes often lag leading economic indicators.

- Cost of Living: When inflation drives up the price of goods and services, it devalues currency and increases the cost of living. For example, with 2024's 2.9% inflation rate, you may want to adjust pay for inflation by increasing an employee's $10,000 annual raise to $10,290. This creates an inflation-adjusted wage that maintains purchasing power.

- Merit: When employee performance exceeds expected contributions, merit-based pay raises may come into play. Keep detailed documents to support your decisions and be transparent with employees to encourage high performance. Merit increases reinforce and reward exceptional contributions.

- Length of Service: Consider giving raises to employees who achieve milestones, such as reaching five years with your company. Raises for tenure can demonstrate to your employees that you appreciate their dedication and aim to keep experienced team members long-term.

- Retention: Pay raises can help reduce unwanted turnover, which is expensive and can negatively affect morale, brand reputation, and company culture. However, since not all employees leave because of pay, engagement surveys and exit interviews can help you understand what drives retention.

- Reputation: Paying competitive wages that keep pace with inflation and the cost of living can help boost your employer brand and establish you as an employer of choice in a competitive market.

- Industry: Pay raises vary significantly depending on industry and market conditions. Stay informed about compensation trends in your sector to ensure your increases remain competitive while aligning with industry standards.

Retain Your Best Employees with Pay Raises

Strategic, consistent pay raises that account for market conditions and inflation can help an employer retain employees longer and maximize their contributions and performance. By taking a thoughtful approach to compensation—one that considers inflation and higher talent retention costs, among other key factors—you can create an environment where employees want to stay and do their best work.

1 2025 Priorities for Business Leaders, Paychex

Consistent Pay Raises Require Modern Payroll Solutions

Find out why approximately 800,000 businesses trust their payroll software with Paychex. Minimize your time processing payroll and grow your company with Paychex. It’s in the name.

Tags