24/7 Access to W-2s

Make the process of distributing annual tax forms more efficient by providing employees online, self-service access. If you decide only to provide the forms online, make sure your employees are registered for the appropriate Paychex platform below. The forms are also available for you to print.

Scroll Down

To Discover More

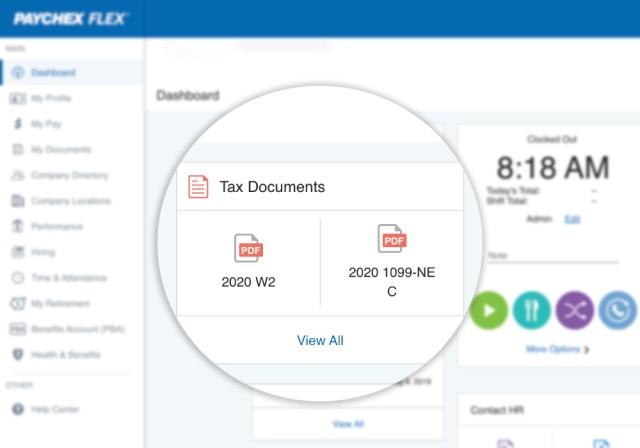

Find Your W-2 within Paychex Flex

Employees Looking for W-2s in Paychex Flex

- Log in to Paychex Flex.

- Under Tax Documents, click the PDF icon to download your W-2 or 1099.

Not registered for Paychex Flex? Learn how to here.

Paychex Flex Administrator Looking for W-2s in Paychex Flex

- Go to W-2 – Wage and Tax Statement. Once you’re logged in to Paychex Flex, you’ll see a list of available Forms W-2.

- Select the ones you’d like to download.

- Click Download.

- Click Keep Separate.

- Save the files to your computer and provide each employee with their W-2.

Note: An employee must consent (either electronically or by paper) to receive Form W-2 electronically. Refer to the specific instructions from the IRS (Publication 15-A). Best practice when emailing forms with confidential information to employees is to send via secure email and double-check that the proper Form W-2 is attached.

Get your employees registered on Paychex Flex—here’s an easy guide to help them get started, in both English and Spanish.

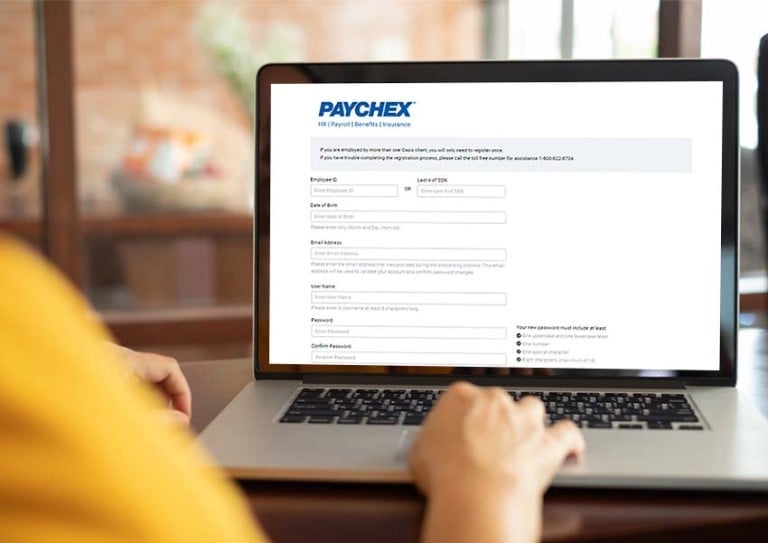

Register For a Paychex Flex Account

Did you know that you can have access to your important HR and payroll data at your fingertips anywhere, anytime? Through the self-service capabilities we’ve built into our application, Paychex Flex®, you can perform some of the most common tasks yourself on-the-go and on any device.

Frequently Asked Questions Regarding W-2s in Paychex Flex

-

When will W-2s be available in Paychex Flex?

When will W-2s be available in Paychex Flex?

Admins and employees will be able to access their W-2s on January 2, 2024.

-

Is there anything I need to do before January to prepare for W-2s?

Is there anything I need to do before January to prepare for W-2s?

Yes, employers and employees should verify that all employee names, mailing addresses, and Social Security Numbers (SSN) are accurate in Paychex Flex.

-

I can’t log in to Paychex Flex to see my W-2 online.

I can’t log in to Paychex Flex to see my W-2 online.

- Make sure you are logging in to paychexflex.com (the site redirects to myapps.paychex.com). Using a bookmark may lead to issues signing in.

- Use Google Chrome or Firefox for the best user experience, and make sure you have the Minimum System Requirements.

- Forgot your password or username? No worries! Just click Forgot Username or Password? and we’ll guide you through it.

-

I’m logged in to Paychex Flex. How do I find my W-2?

I’m logged in to Paychex Flex. How do I find my W-2?

- From the Dashboard, select Tax Documents.

- Click the PDF icon to View All.

- Click the name of the tax document you want to see.

- Click View PDF.

-

What’s the best way to print W-2s I’ve downloaded from Paychex Flex?

What’s the best way to print W-2s I’ve downloaded from Paychex Flex?

We recommend using Google Chrome for the best printing experience.

- Open the PDF in Google Chrome and print it.

- Next to Destination, choose your printer.

- Click More Settings.

- Next to Paper Size, select Letter.

- Next to Scale, select Fit to Printable Area.

- Click Print.

Following these instructions means the W-2 will fit in a standard IRS stock envelope with the mailing address aligned.

-

I’m logged in to Paychex Flex, but I can’t see my W-2.

I’m logged in to Paychex Flex, but I can’t see my W-2.

- Use Google Chrome for the best user experience.

- Simple troubleshooting step: Clear cookies and cache.

- Looking for your W-2? They will be available to admins and employees on January 2.

- If you can’t access your W-2 online in Paychex Flex and you haven’t received a paper copy by January 31, you should contact your employer.

-

I’m not able to register for my Paychex Flex account.

I’m not able to register for my Paychex Flex account.

- Have you been paid yet? It’s easiest to register after you’ve received your first paycheck.

- If you can’t figure out who your company’s Paychex Flex admin(s) is, check out this walkthrough of the registration process.

- Regardless of how you register, check with your employer to confirm all personal information is correct, especially name, address, date of birth, and social security number.

-

I’m not receiving my Paychex Flex verification code through text or call.

I’m not receiving my Paychex Flex verification code through text or call.

You can retry the verification code or change the delivery method to select receiving calls instead of text. You can also select another phone number stored on the account.

-

My former employer hasn’t sent me my W-2 yet, and Paychex prepared my checks. Can you send me my W-2?

My former employer hasn’t sent me my W-2 yet, and Paychex prepared my checks. Can you send me my W-2?

Your employer is responsible for providing you with your W-2. You should make every attempt to contact your former employer to request it.

If your former employer used Paychex as its payroll provider in 2023 and has an active account with Paychex Flex, you may be able to sign into your account on Paychex Flex to access your 2023 W-2 online beginning January 6, 2024.

- Log in to Paychex Flex.

- From the Dashboard, select Tax Documents.

- Click the PDF icon to View All.

- Click the name of the tax document you want to see.

- Click View PDF.

Unfortunately, Paychex’s contract is with your employer (or former employer) and we can only act at their direction.

-

What do I do if I can’t get my W-2 from my employer?

What do I do if I can’t get my W-2 from my employer?

Our general suggestions are:

- Make every attempt to contact your employer.

- Try to locate your last pay stub because it could be helpful.

- If it's after mid-February, you can contact the IRS for instructions on how to proceed. Use the phone number in your Form 1040 booklet, or call 1-800-829-1040.

The IRS will offer to complete a form and send it to your employer requesting that a W-2 be sent to you. To do this, the IRS will need the following information:

- Your name, address, phone number, and social security number.

- Your employer's name, address, and phone number.

- Dates of your employment within the tax year.

- Your year-to-date estimate of wages earned.

- Your year-to-date estimate of federal income tax withheld.

If your employer does not respond to this request, the IRS will issue you a substitute Form W-2 based on the information you've provided them. You can then use this form to complete your personal tax return.

-

Why doesn’t my whole Social Security Number show on my W-2?

Why doesn’t my whole Social Security Number show on my W-2?

Paychex truncated employee Social Security Numbers (SSN) on the employee paper copies of Form W-2 for 2023. The first 5 digits of SSN on employee copies of W-2s will be masked. The purpose of this is to protect employee information on paper copies of Form W-2.

Clients and employees will be able to access versions of Form W-2 that display the employee’s full SSN on Paychex Flex®. This change has been made based on IRS guidance which allows the use of truncated Taxpayer Identification Numbers on W-2s furnished to employees.

-

How do I know if my employees have consented to receiving online-only W-2s?

How do I know if my employees have consented to receiving online-only W-2s?

Paychex Flex admins can view a list of employees who consented to online-only W-2s in Paychex Flex. Note: Your ability to view this report depends on your Paychex Flex admin role.

-

If my employees consented to receiving online-only W-2s, what do I need to do?

If my employees consented to receiving online-only W-2s, what do I need to do?

Nothing! Employers are not required to furnish paper W-2s for these employees, unless they request one. Per IRS requirements, any employee who has not consented to receiving their W-2 electronically only must be provided a paper copy.

-

Suppose an employee has chosen to go paperless, and they work for multiple companies that use Paychex Flex. What happens if one of those businesses does not allow online-only W-2s?

Suppose an employee has chosen to go paperless, and they work for multiple companies that use Paychex Flex. What happens if one of those businesses does not allow online-only W-2s?

The employee will receive a paper W-2 from the company that does not permit electronic delivery of W-2s. All other W-2s will be furnished electronically.

-

If I don’t want to allow employees to go paperless with their W-2s, what is the deadline?

If I don’t want to allow employees to go paperless with their W-2s, what is the deadline?

Inform your Service professional by 4:00pm local time on December 29, 2023.

-

Where do I find employer reference copies in Paychex Flex?

Where do I find employer reference copies in Paychex Flex?

Accessing employer reference copies in Paychex Flex is easy. Instructions are available in the Help Center.

-

Why was my employee’s W-2 sent to our business address instead of the employee’s address?

Why was my employee’s W-2 sent to our business address instead of the employee’s address?

If an employee had an address that did not pass United States Postal Service® formatting, Paychex sent the W-2 to the client’s W-2 delivery address to ensure safe delivery of the form. As the employer, you are responsible for providing the W-2 to your employee by January 31.

-

I’m no longer a Paychex client. How do I get my W-2s?

I’m no longer a Paychex client. How do I get my W-2s?

If you are no longer a Paychex client, your W-2s will be printed and shipped to you or directly to your employees. If you are unsure of your W-2 delivery method, please contact us at 833-299-0168.

-

How do I fold a W-2 downloaded from Paychex Flex for an envelope?

How do I fold a W-2 downloaded from Paychex Flex for an envelope?

If using a standard IRS stock envelope, we recommend folding the W-2 in half to align the mailing address on the form to the envelope.

-

I’ve tried everything suggested, but still need help.

I’ve tried everything suggested, but still need help.

We’re here for you! Click the question mark at the bottom right of any Paychex Flex screen, including login, to chat with one of our friendly agents.

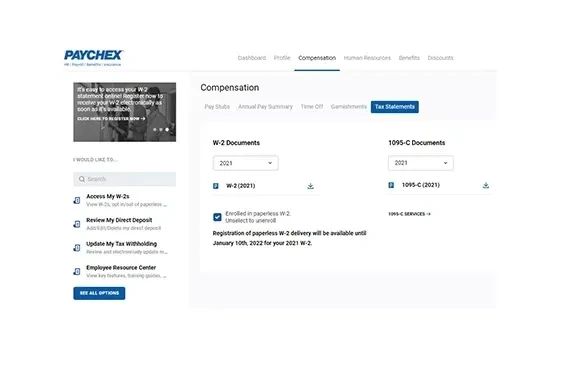

Find Your W-2 within Paychex Oasis

Looking For W-2s and Form 1095-C in the Paychex Oasis portal?

Click here to register to receive your W-2 electronically.

- Follow the step-by-step instructions to create your own personal User ID and password.

- Log in using the User ID and Password you created and select the “Register for Electronic Delivery” option.

- Registration will be available until January 10, 2025.

- When the W-2 is available, you will receive an email with a link to the website where you can log in and retrieve your W-2 at your convenience.

- Save the W-2 on your personal computer for easy retrieval and never pay a reprint fee.

Note: W-2s will be available to worksite employees in the Paychex Oasis portal on/around January 20. If you elect to receive your tax statement electronically, you will not receive a paper copy in the mail. This registration applies to all current and future tax statements Paychex processed.

Hard Copy Retrieval From Paychex Oasis

If you have not registered to receive your W-2 and/or 1095-C electronically, your W-2 will be postmarked by January 31, per IRS guidelines. If you need either form earlier, please follow the above instructions for electronic retrieval. For any questions about your paper W-2 delivery, call our W-2 hotline (866-641-8699) between 8:00 a.m. and 8:00 p.m. ET.

Register For a Paychex Oasis Account

It's simple to access W-2s and other important HR and payroll data through the Paychex Oasis portal. Visit https://portal.oasisassistant.com to get started; just answer a few questions, and you'll be ready to take advantage of all our secure technology platform has to offer.

Frequently Asked Questions Regarding W-2s in Paychex Oasis

-

When will W-2s be sent or mailed to employees?

When will W-2s be sent or mailed to employees?

Electronic W-2s will be available on or around January 20, 2025, for employees in the United States (Puerto Rico employees’ W-2s will be available by January 31). If enrolled in electronic W-2, employees will receive an email to log in to Paychex Oasis to retrieve their W-2 when it becomes available.

Paper W-2s will be postmarked by January 31, 2025. The deadline for making address changes is December 31, 2024, at 5:00 p.m. ET. Forms will be mailed to the address on file in our payroll system at that time.

Due to the heavy volume of U.S. Mail during this time, the USPS recommends allowing seven-14 business days for final delivery. -

How can I verify that Paychex has my correct mailing address?

How can I verify that Paychex has my correct mailing address?

Your W-2 will be delivered to the mailing address listed in Paychex Oasis as of January 10, 2025. Mailing address updates for 2024 W-2s must be entered before 5:00 p.m. ET on December 30, 2024. Follow these steps to make sure your address is updated:

- Log in to the Paychex Oasis portal.

- Select Profile and it will open to Personal Details.

- Select Edit on the right side of the page, then scroll down to Home or Mailing Address.

- Enter a new or updated street address and ZIP code.

- Confirm the address from the pop-up window.

- Scroll to the bottom of the page and select Save.

-

How can I sign up to receive my W-2 electronically?

How can I sign up to receive my W-2 electronically?

Log in to the Paychex Oasis portal and choose W-2 Services. Follow the instructions to create a user ID and password and elect to receive your W-2 electronically at that point in the process. Employees must sign up before January 10, 2025, to receive 2024 forms electronically.

-

If I didn't register for electronic delivery, how can I get a copy of my W-2?

If I didn't register for electronic delivery, how can I get a copy of my W-2?

If you didn't register for electronic delivery before the January 10 deadline, you can still log in to the Paychex Oasis portal to set up your account and retrieve your form electronically. However, you will not be notified when your electronic W-2 is available and will need to check back regularly. If you have not made an electronic delivery election, the W-2 will be mailed via USPS mail to your W-2 address on file as of January 10, 2025.

-

How can I register to receive electronic W-2s in the future?

How can I register to receive electronic W-2s in the future?

Employees can register for electronic W-2 delivery at any time. This registration carries over from year to year so there is no need to register again if you have previously registered. If you did not register prior to the January 10 deadline, you can still register and retrieve your W-2 electronically.

-

What if my W-2 is incorrect?

What if my W-2 is incorrect?

W-2Cs, a form used to report a correction to a W-2, are processed in February. Please call our W-2 hotline (866-641-8699) between 8:00 a.m. and 8:00 p.m. ET to be directed to the proper department for help. Note: If an employee consented to an online W-2, they will now be able to access their W-2C online as well.

-

I can't log in to the Paychex Oasis portal to see my W-2 online.

I can't log in to the Paychex Oasis portal to see my W-2 online.

- Make sure you are logging in to portal.oasisassistant.com.

- Forgot your password or username? No worries! Just click the Need Help Logging In? link on the Paychex Oasis login page and we’ll guide you through it.

-

I’m logged in to the Paychex Oasis portal, but I can’t see my W-2 or 1099.

I’m logged in to the Paychex Oasis portal, but I can’t see my W-2 or 1099.

- Simple troubleshooting step: Clear cookies and cache. (Chrome | Firefox | Microsoft Edge | Safari)

- Looking for your W-2/1099? They will be available online in January.

If you can’t access your W-2/1099 online in the Paychex Oasis portal and you haven’t received a paper copy, contact our hotline (866-641-8699) between 8:00 a.m. and 8:00 p.m. ET.

-

I’m not able to register for my Paychex Oasis account.

I’m not able to register for my Paychex Oasis account.

- Have you been paid yet? It’s easiest to register after you’ve received your first paycheck.

- Check with your employer to confirm all personal information is correct, especially name, address, date of birth, and social security number.

- Paychex Oasis Registration instructions. Spanish instructions are also available.

-

I’m not receiving my Paychex Oasis verification code through text or call.

I’m not receiving my Paychex Oasis verification code through text or call.

You can try re-sending the verification code or you can try having the code sent to another phone number. If necessary, call our W-2 hotline (866-641-8699) between 8:00 a.m. and 8:00 p.m. ET to change the phone number stored on your account. We also recommend reviewing our MFA instructional guide.

-

My former employer hasn’t sent me my W-2 yet, and Paychex prepared my checks. Can you send me my W-2?

My former employer hasn’t sent me my W-2 yet, and Paychex prepared my checks. Can you send me my W-2?

If your former employer used Paychex as its payroll provider in 2024 and has an active account with Paychex, you may be able to sign into your account on the Paychex Oasis portal to access your 2024 W-2 online in January 2025:

- Log in to the Paychex Oasis portal.

- From the Dashboard, select Compensation.

- Select Tax Statements.

- Select the correct year and press the download icon to the right.

- Open and view PDF.

If you are unable to access the system, contact our W-2 hotline (866-641-8699) between 8:00 a.m. and 8:00 p.m. ET for additional support.

-

How can I have my W-2 sent to me?

How can I have my W-2 sent to me?

Your W-2 is available in the Paychex Oasis portal. You may also contact our W-2 hotline (866-641-8699) to request a copy.

-

I’ve tried everything suggested, but I still need help.

I’ve tried everything suggested, but I still need help.

We’re here to help! Contact our W-2 hotline (866-641-8699) between 8:00 a.m. and 8:00 p.m. ET for additional support.