401(k) and Retirement Plan Services

Empower your employees and business when using retirement services to secure a more stable future with:

- The nation’s top 401(k) provider¹ for industry-leading expertise

- Flexible 401(k) plan and investment options to stay competitive

- Fee transparency – clear pricing, no hidden fees

Benefits Administration Made Easy With Paychex

Design Your Plan

We’ll help you understand the different advantages of each plan so you can find one that best fits you and your employees’ retirement plan needs.

Combine Your 401(k) With Payroll

When searching for 401(k) providers, choose one that combines retirement, payroll, and other benefits administration into one platform to simplify management, reduce errors, and save you time and money.

Investment Choice & Transparency

Choose from thousands of 401(k) investment options. Also, our fee transparency means you know exactly what you’re paying for.

Affordable 401(k) Plans for Any Sized Business

Small business owners often think they can’t afford to offer a 401(k) plan. We can help you find a plan that allows your employees to achieve their retirement goals while putting tax savings in your pocket.

Find the Best Retirement Plan Option for You

A New Way To Save

The Paychex Pooled Employer 401(k) Plan (PEP) takes the administrative burden off the employer's plate. By pooling assets into one large plan, employers can save on administrative costs and time, see tax credit opportunities under the SECURE Act, and can offer a high-quality retirement plan to employees.

Appealing to Both Employee & Employer

A 401(k) account is a sought-after employee benefit that allows participants to contribute a portion of their wages on a pre-tax or after-tax ROTH basis. Employees can plan for their future, and the employer can stay competitive for top talent. Consider the addition of a safe harbor 401(k) to avoid possible complications associated with managing traditional retirement plans.

You Don’t Have To Do It Alone

Retirement accounts are still available to you if you’re a one-person business. This type of plan, sometimes referred to as an Owner-only 401(k) plan, maximizes contributions because self-employed individuals can act as employer and employee, adding to their retirement savings in both capacities.

Built for Smaller Businesses

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is designed for small employers, allowing employees to save for retirement with tax-deferred dollars. When evaluating this against a 401(k) retirement plan, understand that each plan may be a better fit for particular companies based on the size and needs of employees.

Cost-Efficient and Simple Administration

A Multiple Employer Plan (MEP) is a single retirement plan available to employers with a commonality. This type of plan is typically sponsored by a professional employer organization (PEO). By pooling resources, employers can save time and money.

SECURE Act 2.0 Can Help You Save

With the passing of SECURE Act 2.0, the time is now to offer a retirement plan. We can help you navigate the latest changes and increased tax incentives to better your business and retain happy employees.

Small Business Retirement Plan Startup Tax Credits

Legislation has been passed to motivate small employers to offer retirement plans and boost employees’ path to financial security. If eligible, your business may have 100% of plan startup costs covered through small business tax credits, which means your plan could be virtually free for the first three years.

Secure Act FAQs

With the most significant retirement savings reform legislation of the last 15 years being passed, it’s natural to have lingering questions. With retirement plans now in reach for both the employer and employee, we’ve highlighted the biggest takeaways to be aware of.

Take Advantage of Savings

Offering the Pooled Employer Plan (PEP) under the SECURE Act reduces risk and simplifies administration. It also provided extra time for employers to start 401(k) profit-sharing plans.

SECURE Act Tax Credit Estimator

Due to a recently adopted law, you may now be able to claim tax credits for your business when offering retirement plans to your business.2

Let's See Your Potential SECURE Act Savings

You Could Be Eligible for in Savings Over 5 Years!

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

|---|---|---|---|---|---|

| Total SECURE Act Credits | $0 | $0 | $0 | $0 | $0 |

| Plan Start-up Credits | $0 | $0 | $0 | $0 | $0 |

| Auto-Enrollment Credits | $0 | $0 | $0 | $0 | $0 |

| Employer Contribution/Match Credits | $0 | $0 | $0 | $0 | $0 |

2The interactive estimator and other information on this website, including, without limitation, information derived from using the interactive estimator, are presented for general information purposes only and are not, and should not be considered, financial, legal, tax, accounting, or other advice. You should not consider the interactive estimator or any other information on this website to guarantee any particular outcome or as a substitute for financial, legal, tax, accounting, or other advice in which the facts and circumstances of your company’s particular situation can be considered. We encourage you to consult your own financial, legal, tax, accounting, or other advisors as it pertains to your company’s own unique situation and to obtain answers to any questions you may have. Paychex shall not be responsible or liable for any action, position, or reliance based on or in connection with the interactive estimator or any information contained herein.

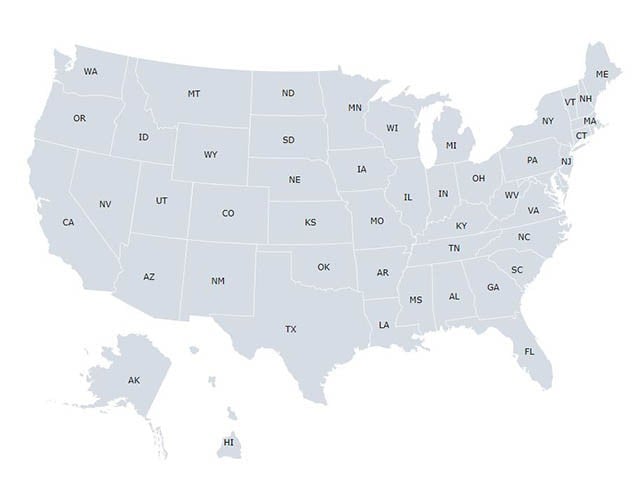

Retirement Savings Requirements for Your State

Every state is different when it comes to retirement savings mandates. Get help staying up to date with your state-sponsored retirement program’s requirements, deadlines, enrollment details, and eligibility criteria.

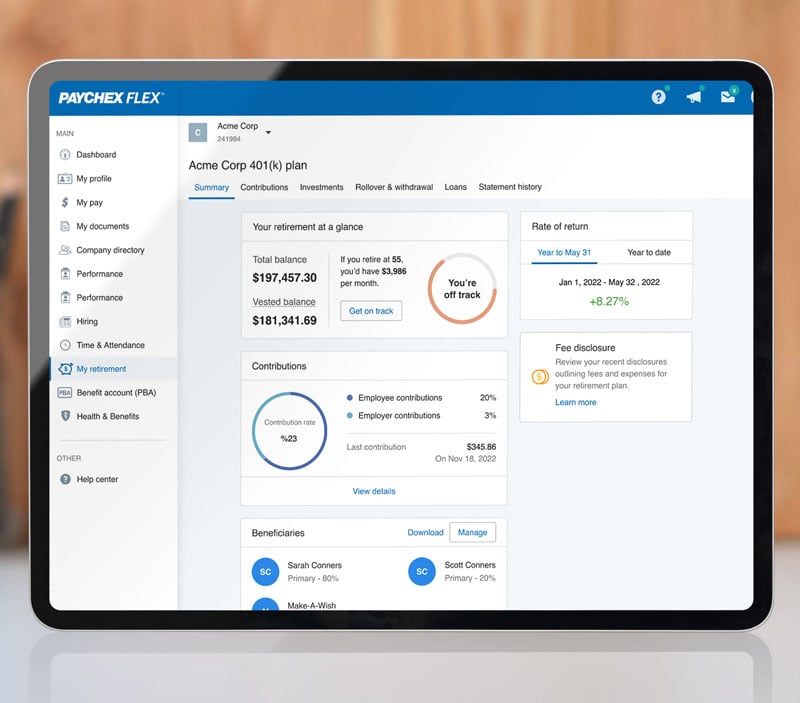

Simplify Retirement Plan Management With Paychex Flex®

Paychex Flex is our all-in-one solution for all things HR, making retirement plan management easier.

-

Give Participants Access to Their Account

Give Participants Access to Their Account

Easily manage accounts, check retirement contribution amounts, maximize 401(k) contributions, review investment performance, and more from the account dashboard.

-

Make It Easy To Enroll in Your Plan

Make It Easy To Enroll in Your Plan

-

Simplify Plan Management

Simplify Plan Management

-

Enabling Better Compliance

Enabling Better Compliance

What Makes Paychex the Most Experienced Retirement Plan Provider

With thousands of investment options, fee transparency, and seamless payroll integration to eliminate manual data entry, we can help your employees save for retirement while saving you time with simplified administration. As the nation’s top 401(k) plan provider¹, we supply retirement plan administration services you can trust.

A Retirement Benefit Offers a Perfect Fix for Employee Retention

Plumbing M.D., a family-owned business headquartered in Dixon, Calif., is required by a state mandate to offer a retirement plan for employees. They wanted to be compliant and find the best plan for their employees.

The owners were surprised by the employee response, as 100% participated. Plumbing M.D. credited the thoroughness of the presentation by Paychex and have recognized that having a retirement plan is great retention tool.

“We’ve had 100% participation (in our retirement plan) .… Having the PEO has helped us provide … an experience they probably won’t get at other similar type of employers (and) that has been helpful with retention.”

Focus on Employee Wellbeing. Offer a Retirement Plan.

Retirement Services FAQs

-

What Are Retirement Services?

What Are Retirement Services?

Retirement services cover the full range of services needed over a plan’s life, particularly for a business or organization managing multiple plans. These can include plan design, investment, conversion, setup, enrollment, administration, and compliance testing.

-

What Is a 401(k) Retirement Plan?

What Is a 401(k) Retirement Plan?

-

What Are the Most Common Retirement Plans?

What Are the Most Common Retirement Plans?

-

What Are the Different Types of 401(k) Plans?

What Are the Different Types of 401(k) Plans?

-

Who Uses Paychex for 401(k)?

Who Uses Paychex for 401(k)?

-

What Are Typical 401(k) Management Fees?

What Are Typical 401(k) Management Fees?

-

How Much Should I Put In My 401(k)?

How Much Should I Put In My 401(k)?

-

How Do I Check My 401(k) Balance with Paychex?

How Do I Check My 401(k) Balance with Paychex?

-

How Do I Contact Paychex Retirement Services?

How Do I Contact Paychex Retirement Services?

-

How Much Does Paychex Charge for 401k?

How Much Does Paychex Charge for 401k?