Working Together to Develop Rapid COVID-19 Relief Solutions for Employers

Since the start of the COVID-19 pandemic, the federal government has provided businesses with relief options such as Paycheck Protection Program (PPP) loans and the Employee Retention Tax Credit (ERTC) to help them stay open. Yet the ability to navigate these options has presented challenges for companies of all sizes. Business leaders aren’t always aware of how they can take advantage of these critical resources. And in some cases, they may not even know that these programs exist. In a recent survey of small business owners, we found that just 39% of respondents knew about the ERTC, and only one in five business owners plan to claim the credit.

Our mission at Paychex is to simplify complex processes for employers. When the pandemic began, we knew that we had to act fast to help our customers ensure that they weren’t leaving any money on the table. Our teams jumped into action to make the necessary enhancements to our payroll systems to be able to support not only the ERTC, but also the Employer Social Security Deferral and the Families First Coronavirus Response Act.

In my role as the Senior Technical Product Manager for our payroll solutions, I work with our product strategy group and IT teams on our Paychex Flex® payroll software. Most recently, I’ve been overseeing the implementation of the company’s PPP solutions.

When the CARES Act passed in late March 2020, Paychex was one of the first companies to release a report to assist clients in applying for a PPP loan. More recently, we made the process even simpler for our clients with an integration to Biz2Credit, a third party lender, which – through a secure API – allows customers to feed the necessary payroll data from Paychex Flex to Biz2Credit and apply directly for the loan. To date, we’ve helped our customers secure more than $30 billion in PPP relief funds, and we’re continually releasing new solutions to help them find the assistance they need.

One of the most enticing features of PPP is if the funds are used on eligible costs, the loan can be completely forgiven – essentially turning it into a federal grant. However, the PPP loan forgiveness process, as well as the stimulus overall, is complicated for businesses to understand and ultimately take advantage of.

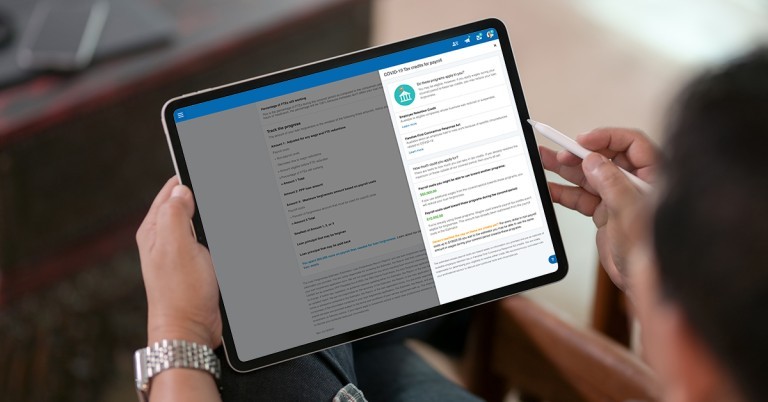

We flagged this challenge early on and quickly developed a Forgiveness Estimator tool in our Paychex Flex, Oasis, and SurePayroll platforms. The Forgiveness Estimator not only pulls together the payroll data needed to apply for forgiveness, it also projects payroll costs over the covered period of the loan, allows clients to enter eligible non-payroll costs, and run “what-if” scenarios to help them understand how they are trending for forgiveness. To further simplify the process, our Paychex Flex and Oasis platforms generate signature-ready copies of the PPP Forgiveness applications.

We continue to enhance our tools as the legislation changes. With the Consolidated Appropriation Act, 2021, clients can now take advantage of both the PPP and ERTC programs (previously employers could only use one of these programs). If a business wants to use both programs they can, but they aren’t able to use the same wages towards both programs. Our newest feature helps clients learn more about the Employee Retention Tax Credit and understand where they may be able to claim more stimulus while still obtaining PPP forgiveness during the same time period.

In the early days of the pandemic, everything was understandably confusing. Legislation was coming out very quickly, and many changes weren’t immediately clear.

Today, we’ve streamlined the process and can quickly pivot our solutions whenever necessary. Our dedicated team of compliance experts, who routinely review federal, state, and local regulations, keep us informed on changes in real-time. When something new comes out related to PPP, I immediately collaborate with a small group of professionals from our compliance, legal, product development, and service teams. We work together to determine what the change(s) will mean for our customers and the solutions that we have in place to serve them. From there, I lead a cross-functional group of about 125 people to help everyone understand the legislation’s impact to our systems. Finally, our marketing team runs in parallel with us to inform clients of the upcoming changes as soon as possible.

One year later, our Paychex team has created a comprehensive set of COVID-19 solutions and resources – including a publicly available COVID-19 Help Center – to support America’s businesses during this unpredictable and challenging time. With each new piece of legislation, we’re keeping our solutions and information up-to-date — often within hours of the legislation passing.

I’m grateful that our cross-functional team has worked so hard throughout the past year to bring these important solutions to market for our customers as quickly as possible. The process hasn’t always been easy, but our commitment to our customers has never wavered. We know that programs like PPP and the latest updates to the ERTC are a lifeline to small and mid-sized businesses. I’m proud that the entire company, including the Paychex family of brands, bands together to help ensure that our customers are able to not only survive but thrive in this challenging time.